Lumber Liquidators 2015 Annual Report Download - page 54

Download and view the complete annual report

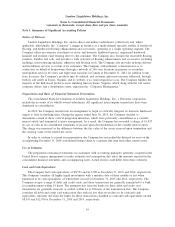

Please find page 54 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.might obtain different estimates if we used different assumptions or conditions. We believe the following

critical accounting policies affect our more significant judgments and estimates used in the preparation of our

financial statements:

Recognition of Net Sales

We recognize net sales for products purchased at the time the customer takes possession of the

merchandise. We recognize service revenue, which consists primarily of installation revenue and freight

charges for in-home delivery, when the service has been rendered. We report sales exclusive of sales taxes

collected from customers and remitted to governmental taxing authorities. Net sales are reduced by an

allowance for anticipated sales returns that we estimate based on historical and current sales trends and

experience. We believe that our estimate for sales returns is an accurate reflection of future returns. Any

reasonably likely changes that may occur in the assumptions underlying our allowance estimates would not be

expected to have a material impact on our financial condition or operating performance. Actual sales returns

did not vary materially from estimated amounts for 2015, 2014 or 2013.

In addition, customers who do not take immediate delivery of their purchases are generally required to

pay a deposit, equal to approximately half of the retail sales value, with the balance payable when the

customer takes possession of the merchandise. These customer deposits benefit our cash flow and return on

investment capital, because we receive partial payment for our customers’ purchases immediately. We record

these deposits as a liability on our balance sheet in customer deposits and store credits until the customer

takes possession of the merchandise.

Merchandise Inventories

We value our merchandise inventories at the lower of merchandise cost or market value. We determine

merchandise cost using the average cost method. All of the hardwood flooring we purchase from suppliers is

either prefinished or unfinished, and in immediate saleable form. To the extent that we finish and box

unfinished products, we include those costs in the average unit cost of related merchandise inventory. In

determining market value, we make judgments and estimates as to the market value of our products, based on

factors such as historical results and current sales trends. Any reasonably likely changes that may occur in

those assumptions in the future may require us to record charges for losses or obsolescence against these

assets, but would not be expected to have a material impact on our financial condition or operating

performance. Actual losses and obsolescence charges did not vary materially from estimated amounts for

2015, 2014 or 2013.

Stock-Based Compensation

We currently utilize a single equity incentive plan under which we may grant non-qualified stock options,

restricted shares, stock appreciation rights and other equity awards to employees, non-employee directors and other

service providers. We recognize expense for our stock-based compensation based on the fair value of the awards that

are granted. Compensation expense is recognized only for those awards expected to vest, with forfeitures estimated at

the date of grant based on our historical experience and future expectations. Measured compensation cost is recognized

ratably over the service period of the entire related stock-based compensation award.

The fair value of stock options was estimated at the date of grant using the Black-Scholes-Merton

valuation model. In order to determine the related stock-based compensation expense, we used the following

assumptions for stock options granted during 2015:

• Expected life of 5.5 years;

• Expected stock price volatility of 50%;

• Risk-free interest rate of 1.7%; and

• Dividends are not expected to be paid in any year.

The expected stock price volatility is based on the historical volatility of our stock price. The volatility is

estimated for a period of time equal to the expected term of the related option. The risk-free interest rate is

based on the implied yield of U.S. Treasury zero-coupon issues with an equivalent remaining term. The

44