Lumber Liquidators 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

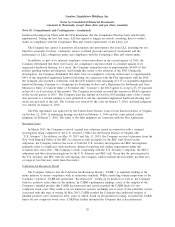

Note 10. Commitments and Contingencies − (continued)

additional deconstructive testing on certain finished products it obtained in March 2015, with certain of the

samples of the Company’s products exceeding the CARB limits for raw composite wood cores.

The Company has been fully cooperative with CARB as CARB continues to work on this matter by,

among other things, providing CARB with requested information related to the products CARB tested and

removing laminate flooring sourced from China from its stores in California. Based on discussions with

CARB, the Company’s best estimate of the probable loss that may result from this matter is approximately

$1,500, which the Company recorded in other current liabilities and selling, general and administrative

expenses in the fourth quarter of 2015. The Company believes that there is at least a reasonable possibility

that a loss greater than the amount accrued may be incurred, but the Company is unable to estimate the

amount at this time.

Securities Litigation Matter

On or about November 26, 2013, Gregg Kiken (‘‘Kiken’’) filed a securities class action lawsuit (the

‘‘Kiken Lawsuit’’), which was subsequently amended, in the United States District Court for the Eastern

District of Virginia against the Company, its founder, former Chief Executive Officer and President, former

Chief Financial Officer and former Chief Merchandising Officer (collectively, the ‘‘Kiken Defendants’’). On or

about September 17, 2014, the City of Hallandale Beach Police Officers’ and Firefighters’ Personnel

Retirement Trust (‘‘Hallandale’’) filed a securities class action lawsuit (the ‘‘Hallandale Lawsuit’’) in the

United States District Court for the Eastern District of Virginia against the Company, its former Chief

Executive Officer and President and its former Chief Financial Officer (collectively, the ‘‘Hallandale

Defendants,’’ and with the Kiken Defendants, the ‘‘Defendants’’). On March 23, 2015, the court consolidated

the Kiken Lawsuit with the Hallandale Lawsuit, appointed lead plaintiffs and lead counsel for the consolidated

action, and captioned the consolidated action as In re Lumber Liquidators Holdings, Inc. Securities Litigation.

The lead plaintiffs filed a consolidated amended complaint on April 22, 2015. The consolidated amended

complaint alleges that the Defendants made material false and/or misleading statements that caused losses to

investors. In particular, the lead plaintiffs allege that the Defendants made material misstatements or omissions

related to their compliance with the l Lacey Act, the chemical content of certain of their wood products, and

their supply chain and inventory position. The lead plaintiffs do not quantify any alleged damages in their

consolidated amended complaint but, in addition to attorneys’ fees and costs, they seek to recover damages on

behalf of themselves and other persons who purchased or otherwise acquired the Company’s stock during the

putative class period at allegedly inflated prices and purportedly suffered financial harm as a result. The

Defendants moved to dismiss the consolidated amended complaint but, on December 21, 2015, the court

denied this motion. The Company disputes these claims and intends to defend the matter vigorously. Given

the uncertainty of litigation, the current status of the case, and the legal standards that must be met for, among

other things, class certification and success on the merits, the Company cannot estimate the reasonably

possible loss or range of loss that may result from this action.

NW Bamboo Matter

On February 27, 2014, NW Bamboo Trim, Inc. (‘‘NWBT’’) filed suit in the Circuit Court of the City of

Richmond, Virginia against the Company and a supplier of bamboo trim products (the ‘‘Supplier’’). In its

complaint, NWBT alleges that (i) the Company breached a contract with NWBT by not purchasing certain

products from NWBT, (ii) the Company tortiously interfered with NWBT’s relationship with the Supplier, and

(iii) the Company and the Supplier conspired to harm NWBT’s business. The Company filed a motion seeking

to dismiss the claims, which was granted as it pertained to the breach of contract claim. The case then

proceeded on the two remaining causes of action.

71