Lumber Liquidators 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

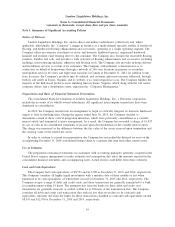

Note 1. Summary of Significant Accounting Policies − (continued)

Advertising Costs

Advertising costs charged to selling, general and administrative (‘‘SG&A’’) expenses, net of vendor

allowances, were $77,455, $82,604 and $75,506 in 2015, 2014 and 2013, respectively. The Company uses

various types of media to brand its name and advertise its products. Media production costs are generally

expensed as incurred, except for direct mail, which is expensed when the finished piece enters the postal

system. Media placement costs are generally expensed in the month the advertising occurs, except for

contracted endorsements and sports agreements, which are generally expensed ratably over the contract period.

Amounts paid in advance are included in prepaid expenses and totaled $1,495 and $1,549 at December 31,

2015 and 2014, respectively.

Store Opening Costs

Costs to open new store locations are charged to SG&A expenses as incurred, net of any vendor support.

Other Vendor Consideration

Consideration from non-merchandise vendors, including royalties and rebates, are generally recorded as

an offset to SG&A expenses when earned.

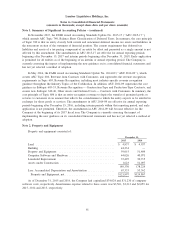

Depreciation and Amortization

Property and equipment is carried at cost and depreciated on the straight-line method over the estimated

useful lives. The estimated useful lives for leasehold improvements are the shorter of the estimated useful

lives or the remainder of the lease terms. For leases with optional renewal periods, the Company uses the

original lease term, excluding optional renewal periods, to determine the appropriate estimated useful lives.

Capitalized software costs are capitalized from the time that technological feasibility is established until the

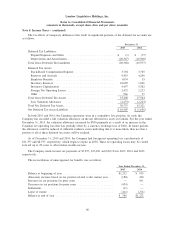

software is ready for use. The estimated useful lives are generally as follows:

Years

Buildings and Building Improvements .................................. 15to40

Property and Equipment ........................................... 5to25

Computer Software and Hardware ..................................... 3to10

Leasehold Improvements ........................................... 1to15

Operating Leases

The Company has operating leases for its stores, Corporate Headquarters, certain of its distribution

facilities, supplemental office facilities and certain equipment. The lease agreements for certain stores and

distribution facilities contain rent escalation clauses, rent holidays and tenant improvement allowances. For

scheduled rent escalation clauses during the lease terms or for rental payments commencing at a date other

than the date of initial occupancy, the Company records minimum rental expenses in SG&A expenses on a

straight-line basis over the terms of the leases. The difference between the rental expense and rent paid is

recorded as deferred rent on the consolidated balance sheets. For tenant improvement allowances, the

Company records deferred rent on the consolidated balance sheets and amortizes the deferred rent over the

terms of the leases as reductions to rental expense.

Stock-Based Compensation

The Company records compensation expense associated with stock options and other forms of equity

compensation in accordance with FASB ASC 718. The Company may issue incentive awards in the form of

stock options, restricted shares and other equity awards to employees, non-employee directors and other

service providers. The Company recognizes expense for its stock-based compensation based on the fair value

59