Lumber Liquidators 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

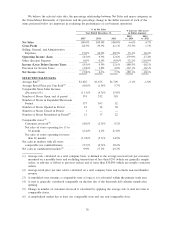

Results of Operations

For an understanding of the significant factors that influenced our performance during the past three

fiscal years, the following discussion should be read in conjunction with the Consolidated Financial

Statements and the Notes to Consolidated Financial Statements presented in this report.

Fiscal 2015 Compared to Fiscal 2014

Net Sales

Net sales for 2015 decreased $68.6 million, or 6.6%, from 2014 as net sales in comparable stores

decreased $116.2 million which was partially offset by an increase in non-comparable stores of $47.6 million.

Net sales in 2015 were impacted by a decrease of 8.0% attributable to the number of customers invoiced and

a decrease of 3.1% in the average sale.

• We believe the number of customers invoiced decreased as a result of a number of factors, including

the impact of the Broadcast on our reputation, our suspension of sales of all laminate product

sourced from China during a large portion of 2015, and disruptions in our supply chain related to

certain engineered product.

• The Company’s average sale decreased as a result of a decrease in the average selling price of our

products offset by slight increases in the volume of product sold. During 2015, the Company

reduced the selling price of its products by 6.0% and focused on the sale of less productive

inventory in order to drive traffic and reduce inventory levels, and in response to negative

allegations impacting the Company’s reputation. These price decreases were found across all of the

products we sell.

• Less than favorable net sales at comparable stores were offset by the expansion of the Company’s

installation program which increased 40.9% to $30.0 million in fiscal year 2015.

Gross Profit

Gross profit decreased 33.3% to $278.9 million from $418.2 million in 2014. Gross profit decreased as

a percentage of sales due to a number of factors including, costs and charges incurred as a result of changes

in the Company’s business in response to the Broadcast, reductions in the average selling price of our

products, and other changes to our business. Notable items impacting gross margin include:

• Certain planned reductions in retail prices implemented in late 2014 and greater promotional pricing

beginning in March 2015 to drive customer traffic and reduce inventory levels.

• We incurred costs of $9.4 million for purchases of testing kits and professional fees related to the

Company’s indoor air quality testing program.

• We recorded a write-off related to our suspension of the sale of Chinese laminate products totaling

$22.5 million.

• As more fully described in Part II, Item I — Legal Proceedings,Antidumping and Countervailing

Duties Investigation, we recorded $4.9 million during fiscal 2015 as our best estimate of the

probable loss for antidumping and countervailing duties owed on applicable shipments of engineered

hardwood imported from China.

• We incurred approximately $1.6 million of incremental expenses in conjunction with the

consolidation and transition of the East Coast distribution center, which was completed by the end of

the first quarter of 2015.

• Gross margin in 2015 included approximately $6.6 million in costs related to our decision to

discontinue certain non-core investments.

• We incurred approximately $1.2 million in additional expense during 2014 primarily related to our

Bellawood Re-Launch and higher inventory levels.

37