Lumber Liquidators 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

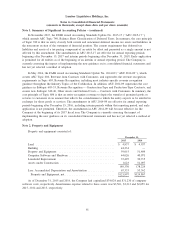

Note 3. Other Current Liabilities

Other current liabilities consisted of:

December 31,

2015 2014

Accrued Legal and Settlement Expense ......................... $14,011 $ 2,087

Other ................................................ 14,744 15,749

Other Current Liabilities, net .............................. $28,755 $17,836

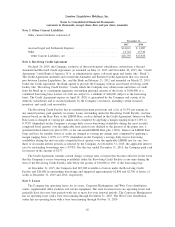

Note 4. Revolving Credit Agreement

On April 24, 2015, the Company, exclusive of the non-domestic subsidiaries, entered into a Second

Amended and Restated Credit Agreement (as amended on May 21, 2015 and November 20, 2015, the ‘‘Credit

Agreement’’) with Bank of America, N.A. as administrative agent, collateral agent and lender (the ‘‘Bank’’).

The Credit Agreement amended and restated the Amended and Restated Credit Agreement that was entered

into between Lumber Liquidators, Inc. and the Bank on February 21, 2012 and amended on March 27, 2015.

Under the Credit Agreement, the Bank agreed to provide the Company with an asset-based revolving credit

facility (the ‘‘Revolving Credit Facility’’) under which the Company may obtain loans and letters of credit

from the Bank up to a maximum aggregate outstanding principal amount of the lesser of $100,000 or a

calculated borrowing base. Letters of credit are subject to a sublimit of $20,000 (subject to the borrowing

base). The Credit Agreement expires on April 24, 2020, is guaranteed by the Company and certain of its

domestic subsidiaries and is secured primarily by the Company’s inventory, including certain in-transit

inventory, and credit card receivables.

The Revolving Credit Facility has no mandated payment provisions and a fee of 0.15% per annum on

any unused portion, paid quarterly in arrears. Loans outstanding under the Revolving Credit Facility can bear

interest based on the Base Rate or the LIBOR Rate, each as defined in the Credit Agreement. Interest on Base

Rate loans is charged at varying per annum rates computed by applying a margin ranging from 0.125% to

0.375% (dependent on the Company’s average daily excess borrowing availability during the most recently

completed fiscal quarter) over the applicable base interest rate (defined as the greatest of the prime rate, a

specified federal funds rate plus 0.50%, or the one-month LIBOR Rate plus 1.00%). Interest on LIBOR Rate

loans and fees for standby letters of credit are charged at varying per annum rates computed by applying a

margin ranging from 1.125% to 1.375% (dependent on the Company’s average daily excess borrowing

availability during the most recently completed fiscal quarter) over the applicable LIBOR rate for one, two,

three or six month interest periods as selected by the Company. At December 31, 2015, the applicable interest

rate for outstanding borrowings was 1.4375%. For the year ended December 31, 2015, the Company paid cash

for interest in the amount of $237.

The Credit Agreement contains a fixed charge coverage ratio covenant that becomes effective in the event

that the Company’s excess borrowing availability under the Revolving Credit Facility at any time during the

term of the Revolving Credit Facility falls below the greater of $10,000 or 10% of the borrowing base.

At December 31, 2015, the Company had $67,200 available to borrow under the Revolving Credit

Facility and $20,000 in outstanding borrowings and supported approximately $2,800 and $2,700 of letters of

credit at December 31, 2015 and 2014, respectively.

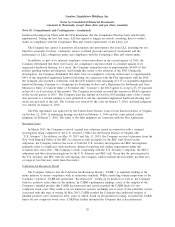

Note 5. Leases

The Company has operating leases for its stores, Corporate Headquarters and West Coast distribution

center, supplemental office facilities and certain equipment. The store location leases are operating leases and

generally have five-year base periods with one or more five-year renewal periods. The Corporate Headquarters

has an operating lease with a base term running through December 31, 2019. The West Coast distribution

center has an operating lease with a base term running through October 31, 2024.

62