Lumber Liquidators 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

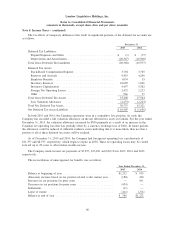

Note 8. Income Taxes − (continued)

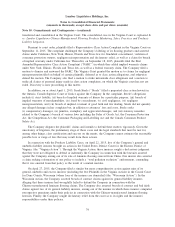

The tax effects of temporary differences that result in significant portions of the deferred tax accounts are

as follows:

December 31,

2015 2014

Deferred Tax Liabilities:

Prepaid Expenses and Other ............................ $ (1) $ (77)

Depreciation and Amortization ........................... (20,367) (16,900)

Total Gross Deferred Tax Liabilities ......................... (20,368) (16,977)

Deferred Tax Assets:

Stock-Based Compensation Expense ....................... 3,794 3,785

Reserves and Accruals ................................ 9,825 4,296

Employee Benefits ................................... 1,034 15

Inventory Reserves .................................. 10,699 1,606

Inventory Capitalization ............................... 4,457 5,582

Foreign Net Operating Losses ........................... 2,433 2,223

Other ............................................ 966 37

Total Gross Deferred Tax Assets ........................... 33,208 17,544

Less Valuation Allowance .............................. (2,433) (2,223)

Total Net Deferred Tax Assets ............................. 30,775 15,321

Net Deferred Tax Asset (Liability) .......................... $10,407 $ (1,656)

In both 2015 and 2014, the Canadian operations were in a cumulative loss position. As such, the

Company has recorded a full valuation allowance on the net deferred tax assets in Canada. For the year ended

December 31, 2015, the valuation allowance increased by $836 primarily as a result of an increase in the

Canadian net operating loss that was partially offset by a currency exchange loss of $626. In future periods,

the allowance could be reduced if sufficient evidence exists indicating that it is more likely than not that a

portion or all of these deferred tax assets will be realized.

As of December 31, 2015 and 2014, the Company had foreign net operating loss carryforwards of

$11,797 and $8,577, respectively, which begin to expire in 2030. These net operating losses may be carried

forward up to 20 years to offset future taxable income.

The Company made income tax payments of $7,855, $33,281 and $30,154 in 2015, 2014 and 2013,

respectively.

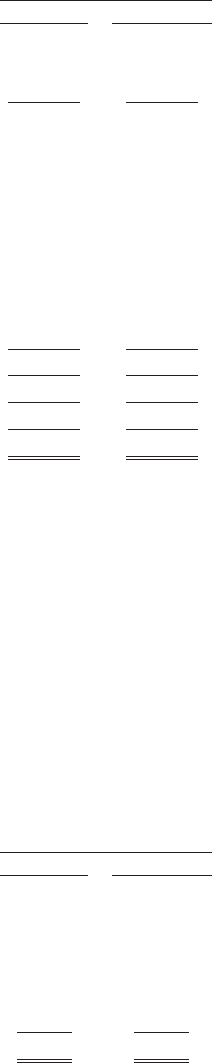

The reconciliation of unrecognized tax benefits was as follows:

Year Ended December 31,

2015 2014

Balance at beginning of year ............................. $1,232 $ 915

(Decrease) increase based on tax position related to the current year . . . (180) 430

Increases in tax positions for prior years ...................... — 161

Decreases in tax positions for prior years ..................... (434) —

Settlements ......................................... (11) —

Lapse of statute ...................................... (211) (274)

Balance at end of year .................................. $ 396 $1,232

68