Lumber Liquidators 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

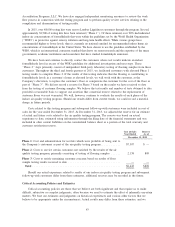

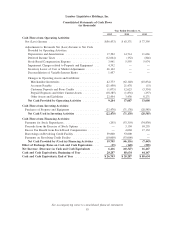

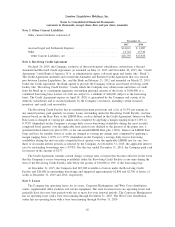

Lumber Liquidators Holdings, Inc.

Consolidated Statements of Cash Flows

(in thousands)

Year Ended December 31,

2015 2014 2013

Cash Flows from Operating Activities:

Net (Loss) Income .............................. $(56,433) $ 63,371 $ 77,395

Adjustments to Reconcile Net (Loss) Income to Net Cash

Provided by Operating Activities:

Depreciation and Amortization .................... 17,392 14,714 11,666

Deferred Income Taxes ......................... (12,064) (152) (846)

Stock-Based Compensation Expense ................ 3,941 5,593 5,974

Impairment Charges related to Property and Equipment . . . 4,392 — —

Inventory Lower of Cost or Market Adjustments ........ 26,162 — —

Deconsolidation of Variable Interest Entity ............ 1,457 — —

Changes in Operating Assets and Liabilities:

Merchandise Inventories ....................... 42,773 (62,140) (45,834)

Accounts Payable ........................... (21,450) 21,478 (15)

Customer Deposits and Store Credits .............. (1,075) 12,623 (3,354)

Prepaid Expenses and Other Current Assets .......... (18,385) (1,836) (257)

Other Assets and Liabilities ..................... 22,494 3,436 8,271

Net Cash Provided by Operating Activities .......... 9,204 57,087 53,000

Cash Flows from Investing Activities:

Purchases of Property and Equipment ................. (22,478) (71,138) (28,585)

Net Cash Used in Investing Activities .............. (22,478) (71,138) (28,585)

Cash Flows from Financing Activities:

Payments for Stock Repurchases ..................... (295) (53,310) (34,830)

Proceeds from the Exercise of Stock Options ............ — 3,150 10,255

Excess Tax Benefit from Stock-Based Compensation ....... — 4,004 17,132

Borrowings on Revolving Credit Facility ............... 39,000 53,000 —

Payments on Revolving Credit Facility ................ (19,000) (53,000) —

Net Cash Provided by (Used in) Financing Activities ... 19,705 (46,156) (7,443)

Effect of Exchange Rates on Cash and Cash Equivalents .... (15) (140) (505)

Net Increase (Decrease) in Cash and Cash Equivalents ..... 6,416 (60,347) 16,467

Cash and Cash Equivalents, Beginning of Year ........... 20,287 80,634 64,167

Cash and Cash Equivalents, End of Year ............... $ 26,703 $ 20,287 $ 80,634

See accompanying notes to consolidated financial statements

53