Lumber Liquidators 2015 Annual Report Download - page 49

Download and view the complete annual report

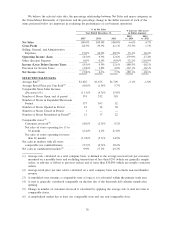

Please find page 49 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross Profit

Gross profit increased 1.7% to $418.2 million from $411.0 million in 2013. Notable items attributing to

increasing gross profit as a percentage of sales include:

• Increases in merchandise sales mix related to moldings and accessories, which generally produce a

gross margin higher than flooring.

• Changes in our supply chain structure, changes in international and domestic transportation rates and

certain operational efficiencies as well as greater costs of merchandise obsolescence and shrink,

including increased inventory reserves, and our increased investment in quality control and

assurance, offset by lower sample and customer satisfaction costs.

• These increases were partially offset by adverse factors related to net shifts in our sales mix of

flooring products, greater ad-hoc discounting at the point of sale, sourcing initiatives and increases in

customers choosing installation and delivery services, which have average gross margins less than

our average merchandise transaction.

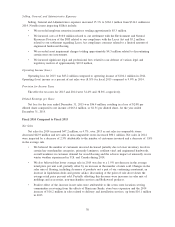

Selling, General and Administrative Expenses

Selling, General and Administrative expenses increased 10.2% to $314.1 million from $285.0 million in

2013. Notable items impacting SG&A include:

• Salaries, commissions and benefits in 2014 increased primarily due to store base growth, corporate

support, including global compliance, our test of installation services management, the start-up and

operations of the West Coast distribution center and higher net cost of benefits. These expenses were

partially offset in 2014 by lower commission rates earned by our store management and lower

accruals related to our management bonus plan, as compared to 2013.

• We incurred cost increases in occupancy and depreciation and amortization primarily due to store

base expansion and incremental expense related to the West Coast distribution center, which became

fully operational during the first quarter of 2014.

• Our stock-based compensation costs, which included a special grant of restricted stock to certain

members of management in March 2013 which fully vested in March 2014 and a special award to

our former chief executive officer Rob Lynch, resulted in approximately $0.8 million and

$0.6 million of expense in 2014 and 2013, respectively.

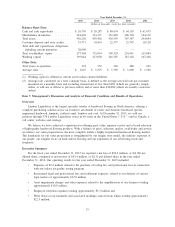

Operating Income

Operating income for 2014 decreased $21.9 million over 2013 as the $7.2 million increase in gross profit

was more than fully offset by a $29.1 million increase in SG&A expenses.

Provision for Income Taxes

The effective tax rate for both 2014 and 2013 was 38.8%.

Diluted Earnings per Share

Net income for the year ended December 31, 2014 was $63.4 million, or $2.31 per diluted share

compared to net income of $77.4 million, or $2.77 per diluted share, for the year ended December 31, 2013.

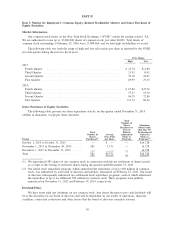

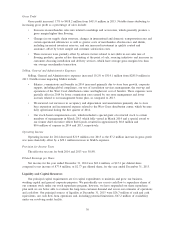

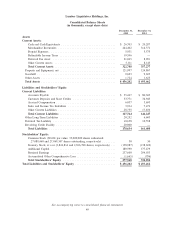

Liquidity and Capital Resources

Our principal capital requirements are for capital expenditures to maintain and grow our business,

working capital and general corporate purposes. We periodically use excess cash flow to repurchase shares of

our common stock under our stock repurchase program, however, we have suspended our share repurchase

plan until we are better able to evaluate the long-term customer demand and assess our estimates of operations

and cash flow. Our principal sources of liquidity at December 31, 2015 were $26.7 million of cash and cash

equivalents, our cash flow from operations and, including potential limitations, $67.2 million of availability

under our revolving credit facility.

39