Lumber Liquidators 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

Note 10. Commitments and Contingencies − (continued)

in May 2016. Any change in the applicable rates as a result of the third annual review would apply to imports

occurring after the second period of review.

Based on the preliminary rates set in January 2016 in the third annual review for shipments subsequent to

November 2013 (AD) and shipments subsequent to December 2012 (CVD), the Company would owe an

additional $5,300 for all shipments through December 31, 2015. As no rates have been finalized for these

periods, the Company has not recorded an accrual in its consolidated financial statements for the impact of

higher rates for the time periods subsequent to the second annual review. Based on the information available,

the Company believes there is at least a reasonable possibility that an additional charge may be incurred in the

range of $0 to $5,300. A loss greater than this amount may be incurred, but the Company is unable to

estimate the amount at this time.

In February 2016, the DOC initiated the fourth annual review of AD and CVD rates, which the Company

expects will follow a similar schedule as the preceding review.

Other Matters

We are also, from time to time, subject to claims and disputes arising in the normal course of business.

In the opinion of management, while the outcome of any such claims and disputes cannot be predicted with

certainty, our ultimate liability in connection with these matters is not expected to have a material adverse

effect on the results of operations, financial position or cash flows.

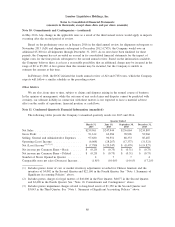

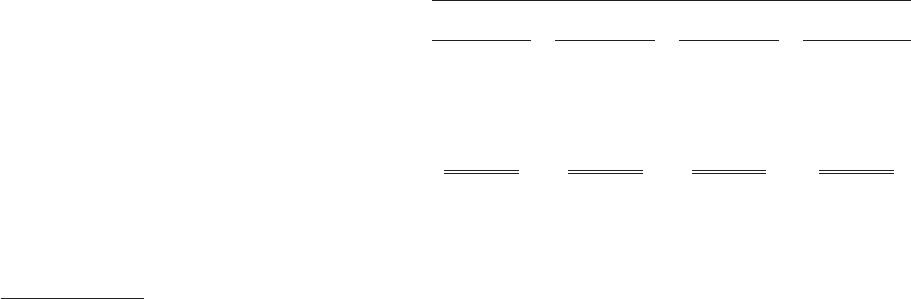

Note 11. Condensed Quarterly Financial Information (unaudited)

The following tables present the Company’s unaudited quarterly results for 2015 and 2014.

Quarter Ended

March 31,

2015

June 30,

2015

September 30,

2015

December 31,

2015

Net Sales ........................... $259,961 $247,944 $236,064 $234,807

Gross Profit ......................... 91,612 62,284 70,996 53,966

Selling, General and Administrative Expenses . . 97,680 90,551 88,333 85,487

Operating (Loss) Income ................ (6,068) (28,267) (17,337) (31,521)

Net (Loss) Income

(1),(2),(3)

................ $ (7,780) $ (20,347) $ (8,479) $ (19,827)

Net income per Common Share − Basic ...... $ (0.29) $ (0.75) $ (0.31) $ (0.73)

Net income per Common Share − Diluted ..... $ (0.29) $ (0.75) $ (0.31) $ (0.73)

Number of Stores Opened in Quarter ........ 4 7 7 4

Comparable store net sales (Decrease) Increase . . (1.8)% (10.0)% (14.6)% (17.2)%

(1) Includes pretax lower of cost or market inventory adjustments recorded for Chinese laminate and tile

inventory of $4,002 in the Second Quarter and $22,160 in the Fourth Quarter. See ‘‘Note 1. Summary of

Significant Accounting Policies’’ above.

(2) Includes pretax charges for legal matters of $10,000 in the First Quarter, $8,077 in the Second Quarter,

and $2,400 in the Fourth Quarter. See ‘‘Note 10. Commitments and Contingencies’’ above.

(3) Includes pretax impairment charges related to long-lived assets of $1,350 in the Second Quarter and

$3,043 in the Third Quarter. See ‘‘Note 1. Summary of Significant Accounting Policies’’ above.

80