Lumber Liquidators 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

Note 1. Summary of Significant Accounting Policies − (continued)

based on estimates of the ultimate costs to be incurred to settle known claims and claims incurred but not

reported as of the balance sheet date. The estimated liability is not discounted and is based on a number of

assumptions and factors including historical and industry trends and economic conditions. This liability could

be affected if future occurrences and claims differ from these assumptions and historical trends. As of

December 31, 2015 and 2014, an accrual of $1,976 and $1,585 related to estimated claims was included in

other current liabilities, respectively.

Recognition of Net Sales

The Company recognizes net sales for products purchased at the time the customer takes possession of

the merchandise. Service revenue, primarily installation revenue and freight charges for in-home delivery, is

included in net sales and recognized when the service has been rendered. The Company reports sales

exclusive of sales taxes collected from customers and remitted to governmental taxing authorities, and net of

an allowance for anticipated sales returns based on historical and current sales trends and experience. The

sales returns allowance and related changes were not significant for 2015, 2014 or 2013.

In total, we offer more than 400 different flooring product stock-keeping units; however, no single

flooring product represented more than 2% of our sales mix. By major product category, our sales mix was as

follows:

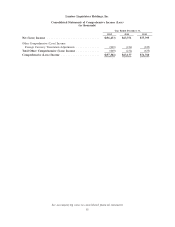

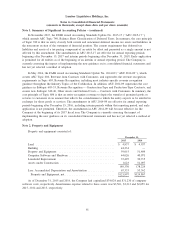

2015 2014 2013

Solid and Engineered Hardwood ............... $378,501 $ 406,887 $ 413,709

Laminate ............................... 153,722 199,775 195,382

Bamboo, Cork, Vinyl Plank and Other ........... 221,776 212,735 193,960

Moldings and Accessories ................... 184,144 195,539 180,713

Non-Merchandise Services ................... 40,633 32,483 16,476

Total ................................ $978,776 $1,047,419 $1,000,240

The Company generally requires customers to pay a deposit, equal to approximately half of the retail

sales value, when purchasing merchandise inventories not regularly carried in a given store location, or not

currently in stock. These deposits are included in customer deposits and store credits until the customer takes

possession of the merchandise.

Cost of Sales

Cost of sales includes the cost of the product sold, cost of installation services, transportation costs from

vendor to the Company’s distribution centers or store locations, any applicable finishing costs related to

production of the Company’s proprietary brands, transportation costs from distribution centers to store

locations, transportation costs for the delivery of products from store locations to customers, certain costs of

quality control procedures, inventory adjustments including shrinkage, and costs to produce samples, reduced

by vendor allowances.

In early March 2015, the Company began voluntarily offering free indoor air quality screening to certain

of its flooring customers, predominately those who had purchased laminate flooring sourced from China, to

address customer questions about the air quality in their homes. During the year ended December 31, 2015,

over approximately 48,000 testing kits were sent to Lumber Liquidators customers through the program. In

total, approximately 30,500 testing kits have been returned. Of those returned, over 90% indicated indoor air

concentrations of formaldehyde within the guidelines set by the World Health Organization (‘‘WHO’’) as

protective against sensory irritation and long-term health effects. The Company has been and continues to

directly contact the customers whose test results indicate an indoor formaldehyde level in excess of the WHO

guideline for additional investigation and next steps. These ‘‘Phase 2’’ steps primarily consist of independent

third-party laboratory testing of flooring samples from these customers. If the results of this testing indicates

57