Lumber Liquidators 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

Note 1. Summary of Significant Accounting Policies − (continued)

Credit Programs

Credit is offered to the Company’s customers through a proprietary credit card, underwritten by a

third party financial institution and generally at no recourse to the Company. A credit line is offered to the

Company’s professional customers through the Lumber Liquidators Commercial Credit Program. This

commercial credit program is underwritten by a third party financial institution, generally with no recourse to

the Company.

As part of the credit program, the Company’s customers may tender their Lumber Liquidators credit card

to receive installation services provided by the Company’s third party installation provider, who is responsible

for all credits and program fees for the related transactions. The Company has agreed to indemnify the

financial institution against any losses related to these credits or fees. There are no maximum potential future

payments under the guarantee. The Company is able to seek recovery from the installation provider of any

amounts paid on its behalf. The Company believes that the risk of significant loss from the guarantee of these

obligations is remote.

Fair Value of Financial Instruments

The carrying amounts of financial instruments such as cash and cash equivalents, accounts payable and

other liabilities approximate fair value because of the short-term nature of these items and the carrying amount

of obligations under our revolving credit facility approximate fair value due to the variable rate of interest.

Of these financial instruments, the cash equivalents are classified as Level 1 as defined in the Financial

Accounting Standards Board Accounting Standards Codification (‘‘FASB ASC’’) 820 fair value hierarchy.

Certain non-financial assets, including property and equipment, have been written down and measured in

the consolidated financial statements at fair value. Fair value was based on expected future cash flows using

Level 3 inputs under ASC 820.

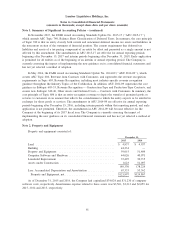

Merchandise Inventories

The Company values merchandise inventories at the lower of cost or market value. Merchandise cost is

determined using the average cost method. All of the hardwood flooring purchased from vendors is either

prefinished or unfinished, and in immediate saleable form. The Company adds the finish to, and boxes, various

species of unfinished product, to produce certain proprietary products, primarily Bellawood, at its finishing

facility. These finishing and boxing costs are included in the average unit cost of related merchandise

inventory. The Company maintains an inventory reserve for loss or obsolescence based on historical results

and current sales trends. This reserve was $26,882 and $3,242 at December 31, 2015 and 2014, respectively.

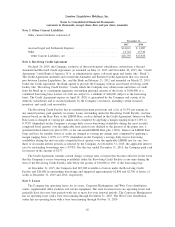

On May 7, 2015, the Company suspended the sale of laminate products sourced from China after certain

allegations were made regarding these products. This inventory has been held in stores and distribution centers

as the Company has continued to evaluate and assess alternatives for the disposition of these products and the

potential implications these alternatives could have on the net realizable value of the laminate flooring

inventory sourced from China. During the quarter ended June 30, 2015, the Company recorded a charge of

approximately $339 related to its laminate flooring sourced from China, primarily for flooring with less than

job-lot quantities on hand as the Company did not intend to purchase additional quantities of such product.

During the quarter ended December 31, 2015, in connection with changes in the executive management team

and based on the most recent evaluation of the alternatives for disposal, which considered strategic and

operational considerations including potential distractions these products could have on the Company’s

employees and business, the Company determined that it would not sell the current inventory of laminate

flooring sourced from China in its stores. As a result of this decision, the Company recorded a charge to

reduce the remaining carrying value of this laminate flooring and related moldings to its net realizable value

of zero. The Company recorded total charges related to laminate flooring sourced from China of $22,499 in

cost of sales for the year ended December 31, 2015 in the accompanying consolidated statements of

55