Lumber Liquidators 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

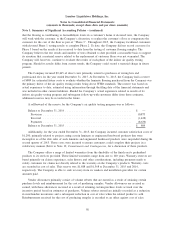

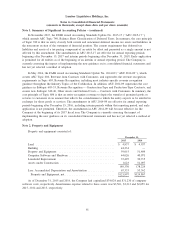

Note 5. Leases − (continued)

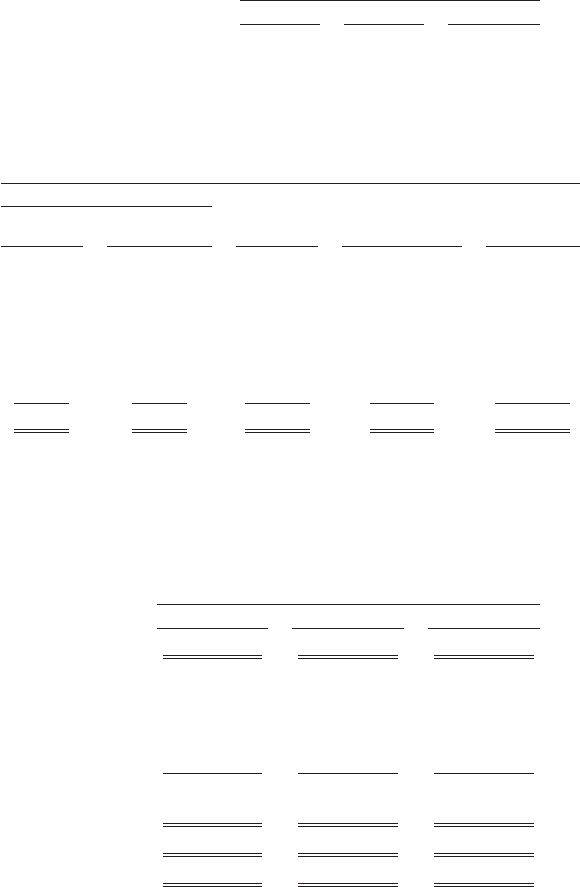

As of December 31, 2015, 2014 and 2013, the Company leased the Corporate Headquarters, which

includes a store location and 30, 30 and 29 of its locations, representing 8.3%, 8.8% and 9.4% of the total

number of store leases in operation, respectively, from entities controlled by the Company’s founder, who also

serves as a member of the Board of Directors (‘‘Controlled Companies’’). During 2015, the Company also

leased a warehouse, from one of the Controlled Companies.

Rental expense is as follows:

Year Ended December 31,

2015 2014 2013

Rental expense ................................ $28,825 $27,995 $21,874

Rental expense related to Controlled Companies ......... 3,070 2,837 2,895

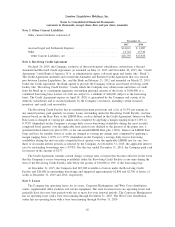

The future minimum rental payments under non-cancellable operating leases, segregating Controlled

Companies leases from all other operating leases, were as follows at December 31, 2015:

Operating Leases

Controlled Companies

Store

Leases

Distribution

Centers & Other

Leases

Total

Operating

Leases

Store

Leases

Headquarters

Lease

2016 ...................... $2,066 $1,271 $24,537 $ 2,411 $ 30,285

2017 ...................... 1,611 1,309 21,214 2,435 26,569

2018 ...................... 1,490 1,348 16,928 2,394 22,160

2019 ...................... 1,121 1,388 13,046 2,305 17,860

2020 ...................... 836 — 9,785 2,361 12,982

Thereafter .................. 1,390 — 12,206 8,452 22,048

Total minimum lease payments . . . $8,514 $5,316 $97,716 $20,358 $131,904

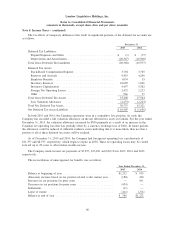

Note 6. Stockholders’ Equity

Net Income per Common Share

The following table sets forth the computation of basic and diluted net income per common share:

Year Ended December 31,

2015 2014 2013

Net (Loss) Income ...................... $ (56,433) $ 63,371 $ 77,395

Weighted Average Common Shares

Outstanding − Basic .................... 27,082,299 27,264,882 27,484,790

Effect of Dilutive Securities:

Common Stock Equivalents .............. — 220,970 429,532

Weighted Average Common Shares

Outstanding − Diluted .................. 27,082,299 27,485,852 27,914,322

Net (Loss) Income per Common Share − Basic . . . $ (2.08) $ 2.32 $ 2.82

Net (Loss) Income per Common Share − Diluted . . $ (2.08) $ 2.31 $ 2.77

63