Lumber Liquidators 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

Note 1. Summary of Significant Accounting Policies − (continued)

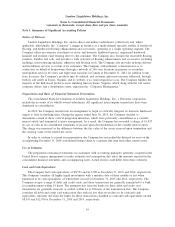

In November 2015, the FASB issued Accounting Standards Update No. 2015-17 (‘‘ASU 2015-17’’),

which amends ASC Topic 740, Balance Sheet Classification of Deferred Taxes. In summary, the core principle

of Topic 740 is that an entity classify both current and noncurrent deferred income tax assets and liabilities in

the noncurrent section of the statement of financial position. The current requirement that deferred tax

liabilities and assets of a tax-paying component of an entity be offset and presented as a single amount is not

affected by this amendment. The amendments in ASU 2015-17 are effective for annual reporting periods

beginning after December 15, 2017 and interim periods beginning after December 31, 2018. Early application

is permitted for all entities as of the beginning of an interim or annual reporting period. The Company is

currently assessing the impact of implementing the new guidance on its consolidated financial statements and

has not yet selected a method of adoption.

In May 2014, the FASB issued Accounting Standards Update No. 2014-09 (‘‘ASU 2014-09’’), which

creates ASC Topic 606, Revenue from Contracts with Customers, and supersedes the revenue recognition

requirements in Topic 605, Revenue Recognition, including most industry-specific revenue recognition

guidance throughout the Industry Topics of the Codification. In addition, ASU 2014-09 supersedes the cost

guidance in Subtopic 605-35, Revenue Recognition — Construction-Type and Production-Type Contracts, and

creates new Subtopic 340-40, Other Assets and Deferred Costs — Contracts with Customers. In summary, the

core principle of Topic 606 is that an entity recognizes revenue to depict the transfer of promised goods or

services to customers in an amount that reflects the consideration to which the entity expects to be entitled in

exchange for those goods or services. The amendments in ASU 2014-09 are effective for annual reporting

periods beginning after December 15, 2016, including interim periods within that reporting period, and early

application is not permitted. Therefore, the amendments in ASU 2014-09 will become effective for the

Company at the beginning of its 2017 fiscal year. The Company is currently assessing the impact of

implementing the new guidance on its consolidated financial statements and has not yet selected a method of

adoption.

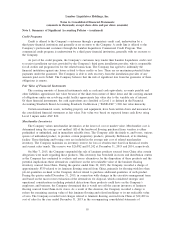

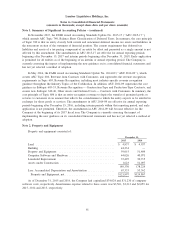

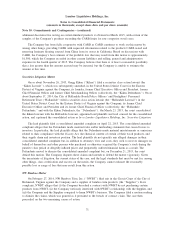

Note 2. Property and Equipment

Property and equipment consisted of:

December 31,

2015 2014

Land .............................................. $ 4,937 $ 4,937

Building ............................................ 44,234 —

Property and Equipment ................................. 59,015 51,409

Computer Software and Hardware ........................... 44,026 40,071

Leasehold Improvement ................................. 35,495 30,715

Assets under Construction ................................ 1,623 51,097

189,330 178,229

Less: Accumulated Depreciation and Amortization ................ 67,333 53,362

Property and Equipment, net ............................. $121,997 $124,867

As of December 31, 2015 and 2014, the Company had capitalized $34,024 and $31,230 of computer

software costs, respectively. Amortization expense related to these assets was $3,501, $3,212 and $2,659 for

2015, 2014 and 2013, respectively.

61