Lumber Liquidators 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

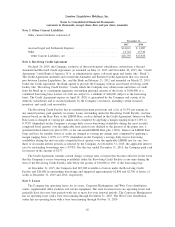

Note 6. Stockholders’ Equity − (continued)

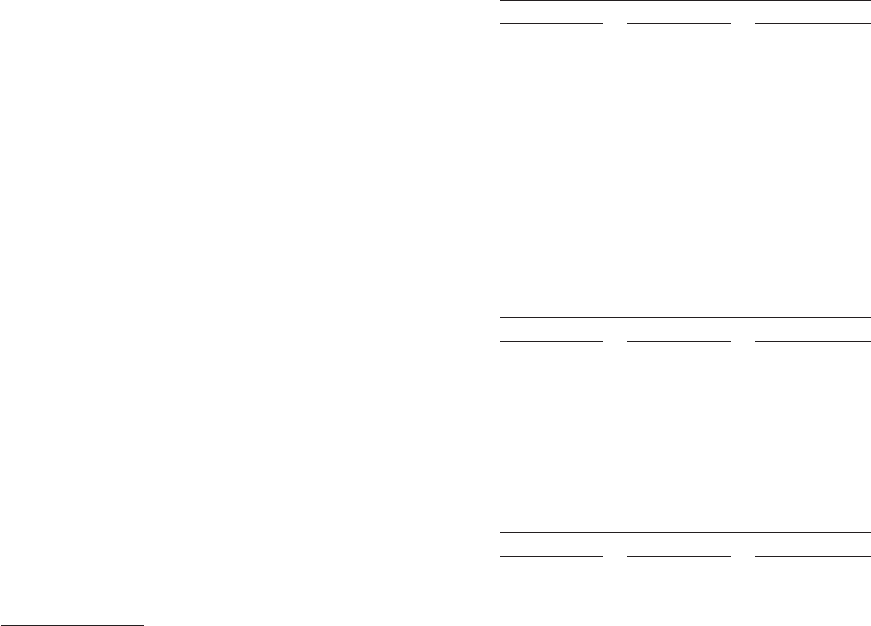

The following have been excluded from the computation of Weighted Average Common Shares

Outstanding — Diluted because the effect would be antidilutive:

As of December 31,

2015 2014 2013

Stock Options .......................... 650,759 184,252 103,329

Restricted Shares ........................ 225,027 16,999 176

Stock Repurchase Program

In 2012, the Company’s Board of Directors (‘‘Board’’) authorized the repurchase of up to $100,000 of

the Company’s common stock from time to time on the open market or in privately negotiated transactions.

In January 2014, the Company’s Board authorized the repurchase of up to an additional $50,000 of the

Company’s common stock, bringing the total authorization to $150,000 and at December 31, 2015, the

Company had $14,728 remaining under this authorization. The Company has not purchased any stock through

privately negotiated transactions. Purchases under this program were as follows:

Year Ended December 31,

2015 2014 2013

Shares Repurchased ...................... — 671,200 403,630

Average Price per Share ................... $— $ 77.68 $ 84.40

Total Aggregate Costs ..................... $— $ 52,138 $ 34,066

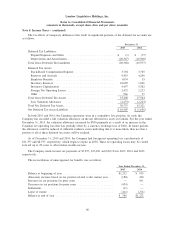

Note 7. Stock-Based Compensation

Stock-based compensation expense included in SG&A expenses consisted of:

Year Ended December 31,

2015

(1)

2014 2013

Stock Options, Restricted Shares and Stock

Appreciation Rights ..................... $3,941 $5,593 $5,974

(1) Includes the impact of actual forfeitures in the period due to the resignation of certain senior executives.

Overview

On May 6, 2011, the Company’s stockholders approved the Lumber Liquidators Holdings, Inc. 2011

Equity Compensation Plan (the ‘‘2011 Plan’’), which succeeded the Lumber Liquidators Holdings, Inc. 2007

Equity Compensation Plan. The 2011 Plan is an equity incentive plan for employees, non-employee directors

and other service providers from which the Company may grant stock options, restricted shares, stock

appreciation rights (‘‘SARs’’) and other equity awards. The total number of shares of common stock

authorized for issuance under the 2011 Plan is 5.3 million. As of December 31, 2015, 1.0 million shares of

common stock were available for future grants. Stock options granted under the 2011 Plan expire no later than

ten years from the date of grant and the exercise price shall not be less than the fair market value of the

shares on the date of grant. Vesting periods are assigned to stock options and restricted shares on a grant by

grant basis at the discretion of the Board. The Company issues new shares of common stock upon exercise of

stock options and vesting of restricted shares.

The Company also maintains the Lumber Liquidators Holdings, Inc. Outside Directors Deferral Plan

under which each of the Company’s non-employee directors has the opportunity to elect annually to defer

certain fees until departure from the Board. A non-employee director may elect to defer up to 100% of his or

her fees and have such fees invested in deferred stock units. Deferred stock units must be settled in common

64