Lumber Liquidators 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

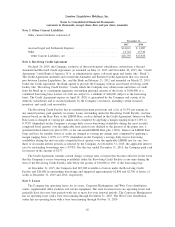

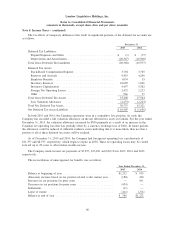

Note 8. Income Taxes − (continued)

As of December 31, 2015, the Company had $0.4 million of gross unrecognized tax benefits, $0.3 million of

which, if recognized, would affect the effective tax rate. It is reasonably possible that the amount of the

unrecognized tax benefit with respect to certain of the uncertain tax positions will increase or decrease during the

next 12 months; however, the Company does not expect the change to have a significant effect on its results of

operations, financial position or cash flows. As of December 31, 2014, the Company had $1.2 million of gross

unrecognized tax benefits, $0.8 million of which, if recognized, would affect the effective tax rate.

The Company files income tax returns with the U.S. federal government and various state and foreign

jurisdictions. In the normal course of business, the Company is subject to examination by taxing authorities.

The Internal Revenue Service has completed audits of the Company’s federal income tax returns for years

through 2009.

Note 9. Profit-sharing Plan

The Company maintains a profit-sharing plan, qualified under Section 401(k) of the Internal Revenue

Code, for all eligible employees. Employees are eligible to participate following the completion of

three months of service and attainment of age 21. In 2013, the Company amended the plan to a safe harbor

plan, and began matching 100% of the first 3% of employee contributions and 50% of the next 2% of

employee contributions. Additionally, employees are now immediately 100% vested in the Company’s

matching contributions. Prior to 2013, the Company matched 50% of employee contributions up to 6% of

eligible compensation. The Company’s matching contributions, included in SG&A expenses, totaled $2,019,

$1,937 and $1,590 in 2015, 2014 and 2013, respectively.

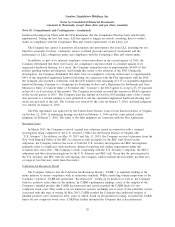

Note 10. Commitments and Contingencies

Government Investigations

Lacey Act Related Matters

On September 26, 2013, sealed search warrants were executed at the Company’s corporate offices in

Toano and Richmond, Virginia by the Department of Homeland Security’s Immigration and Customs

Enforcement and the U.S. Fish and Wildlife Service. The search warrants requested information, primarily

documentation, related to the importation of certain of the Company’s wood flooring products in accordance

with the Lacey Act. Since then, the Company cooperated with the federal authorities, including the

Department of Justice (‘‘DOJ’’), in their investigation.

On October 7, 2015, Lumber Liquidators, Inc. (‘‘LLI’’) reached a settlement with the DOJ in connection

with this investigation. Under the terms of a Plea Agreement with the DOJ (the ‘‘Plea Agreement’’) executed

on October 7, 2015, LLI agreed to plead guilty to one felony count for entry of goods by means of false

statements and four misdemeanor due care counts under the Lacey Act. These violations do not require LLI to

have acted with a deliberate or willful intent to violate the law, and LLI did not stipulate that it acted with

such deliberate or willful intent. As part of the settlement, LLI agreed to pay a combined total of $10,000 in

fines, community service payments and forfeited proceeds. The payments include a $7,800 fine, community

service contributions of $880 and $350 to the National Fish and Wildlife Foundation and the Rhinoceros and

Tiger Conservation fund, respectively, and a $969 forfeiture payment. The Company had previously recorded

this amount in SG&A expenses in the first quarter of 2015. At December 31, 2015, $6,200 was included in

current liabilities and $3,800 was included in other long-term liabilities on the accompanying consolidated

balance sheet. The Company paid $6,200 of the settlement amount in the first quarter of 2016, and the

Company expects to pay $2,000 in the first quarter of 2017 and $1,800 in the first quarter of 2018.

LLI also agreed in the Plea Agreement to implement an environmental compliance plan (the

‘‘Compliance Plan’’) for a probation period of five years. If LLI fails to implement the Compliance Plan

within three months of sentencing, the government may require the Company to cease the importation of

69