Lumber Liquidators 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

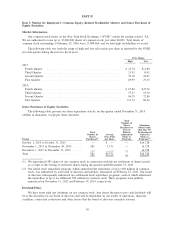

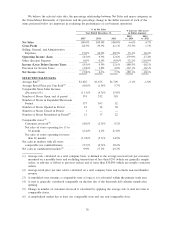

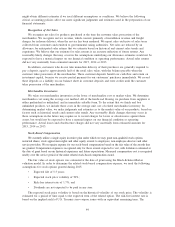

We believe the selected sales data, the percentage relationship between Net Sales and major categories in

the Consolidated Statements of Operations and the percentage change in the dollar amounts of each of the

items presented below are important in evaluating the performance of our business operations.

% of Net Sales % Increase (Decrease)

in Dollar AmountsYear Ended December 31,

2015 2014 2013

2015

vs. 2014

2014

vs. 2013

Net Sales ....................... 100.0% 100.0% 100.0% -6.6% 4.7%

Gross Profit ..................... 28.5% 39.9% 41.1% -33.3% 1.7%

Selling, General, and Administrative

Expenses ...................... 37.0% 30.0% 28.5% 15.3% 10.2%

Operating Income (Loss) ............ (8.5)% 9.9% 12.6% -179.9% -17.4%

Other (Income) Expense ............. 0.0% 0.0% (0.0)% -52.2% -210.9%

Income (Loss) Before Income Taxes .... (8.5)% 9.9% 12.6% -180.5% -18.1%

Provision for Income Taxes ........... (2.8)% 3.8% 4.9% -167.1% -18.1%

Net Income (Loss) ................. (5.8)% 6.1% 7.7% -189.1% -18.1%

SELECTED SALES DATA

Average Sale

(1)

.................... $1,625 $1,675 $1,705 -3.1% -1.8%

Average Retail Price per Unit Sold

(2)

..... (6.0)% (1.9)% 5.7%

Comparable Store Sales Increase

(Decrease) (%) .................. (11.1)% (4.3)% 15.8%

Number of Stores Open, end of period .... 374 352 318

Number of Stores in Expanded Showroom

Format ........................ 137 103 52

Number of Stores Opened in Period ...... 23 34 30

Number of Stores Closed in Period ...... 1 — —

Number of Stores Remodeled in Period

(3)

. . 12 17 22

Comparable stores

(4)

:

Customers invoiced

(5)

.............. (8.0)% (2.5)% 9.2%

Net sales of stores operating for 13 to

36 months .................... (6.2)% 4.2% 21.8%

Net sales of stores operating for more

than 36 months ................ (11.8)% (5.1)% 14.9%

Net sales in markets with all stores

comparable (no cannibalization) ....... (9.5)% (0.3)% 18.2%

Net sales in cannibalized markets

(6)

...... 9.9% 17.2% 45.2%

(1) Average sale, calculated on a total company basis, is defined as the average invoiced sale per customer,

measured on a monthly basis and excluding transactions of less than $250 (which are generally sample

orders, or add-ons or fill-ins to previous orders) and of more than $30,000 (which are usually contractor

orders).

(2) Average retail price per unit sold is calculated on a total company basis and excludes non-merchandise

revenue.

(3) A remodeled store remains a comparable store as long as it is relocated within the primary trade area.

(4) A store is generally considered comparable on the first day of the thirteenth full calendar month after

opening.

(5) Change in number of customers invoiced is calculated by applying the average sale to total net sales at

comparable stores.

(6) A cannibalized market has at least one comparable store and one non-comparable store.

36