Lumber Liquidators 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

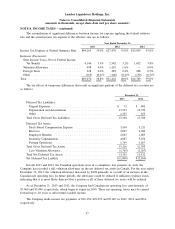

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

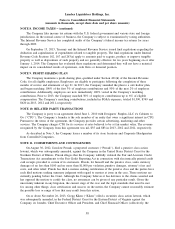

NOTE 11. COMMITMENTS AND CONTINGENCIES − (continued)

‘‘Defendants’’). In the complaint, Kiken alleges that the Defendants made material false and/or misleading

statements and failed to disclose material adverse facts about the Company’s business, operations and

prospects. In particular, Kiken alleges that the Defendants made material misstatements or omissions related to

the Company’s compliance with the federal Lacey Act and the chemical content of its wood products. In

addition to attorney’s fees and costs, Kiken seeks to recover damages on behalf of himself and other persons

who purchased or otherwise acquired the Company’s stock during the putative class period at allegedly

inflated prices and purportedly suffered financial harm as a result. The Company disputes Kiken’s claims and

intends to defend the matter vigorously. Given the uncertainty of litigation, the preliminary stage of the case

and the legal standards that must be met for, among other things, class certification and success on the merits,

the Company cannot reasonably estimate the possible loss or range of loss that may result from this action.

On or about January 14, 2014, the case of Lambert et al. v. Lumber Liquidators Holdings, Inc. was filed

in the United States District Court for the Eastern District of Virginia by four plaintiffs (the ‘‘Original

Plaintiffs’’) on behalf of themselves and a class of persons in Virginia, Alabama and New York who purchased

and installed wood flooring from the Company that was sourced, processed or manufactured in China. The

Original Plaintiffs claim that the Company made certain misrepresentations regarding the chemical emission

levels of the Chinese flooring products that it sells. On February 11, 2014, an amended complaint was filed in

which a number of additional plaintiffs and purported classes were added (collectively with the Original

Plaintiffs, the ‘‘Plaintiffs’’) and the originally named defendant was replaced with a new one, Lumber

Liquidators, Inc. The amended complaint, which is captioned Williamson et al. v. Lumber Liquidators, Inc.,

also states additional claims concerning alleged noncompliance with the federal Lacey Act, namely the

importation and sale of wood products that were originally harvested in Russia without valid authority. The

Plaintiffs accuse the Company of violating the Racketeering and Corrupt Organizations Act and assert dozens

of other legal theories under federal and various state laws including but not limited to the Magnuson-Moss

Warranty Act, breaching of express and implied warranties, and violating certain state consumer protection

and deceptive practice laws. The Plaintiffs seek actual, consequential and punitive damages, pre- and

post-judgment interest, attorney’s fees and costs, and certain equitable and injunctive relief. The Company

disputes the Plaintiffs’ claims and intends to defend this matter vigorously. Given the uncertainty of litigation,

the preliminary stage of the case and the legal standards that must be met for, among other things, class

certification and success on the merits, the Company cannot reasonably estimate the possible loss or range of

loss that may result from this action.

The Company is also, from time to time, subject to claims and disputes arising in the normal course of

business. In the opinion of management, while the outcome of any such claims and disputes cannot be

predicted with certainty, the Company’s ultimate liability in connection with these matters is not expected to

have a material adverse effect on the results of operations, financial position or cash flows.

59