Lumber Liquidators 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividend Policy

We have never paid any dividends on our common stock. Any future decision to pay cash dividends will

be at the discretion of our board of directors and will be dependent on our results of operations, financial

condition, contractual restrictions and other such factors that the board of directors considers relevant.

Securities Authorized for Issuance Under Equity Compensation Plans

See Item 12. ‘‘Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters’’ for information regarding securities authorized for issuance under our equity

compensation plans.

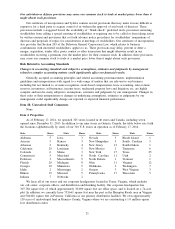

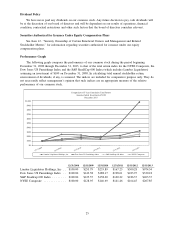

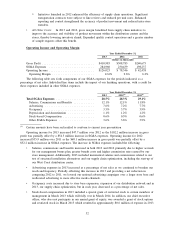

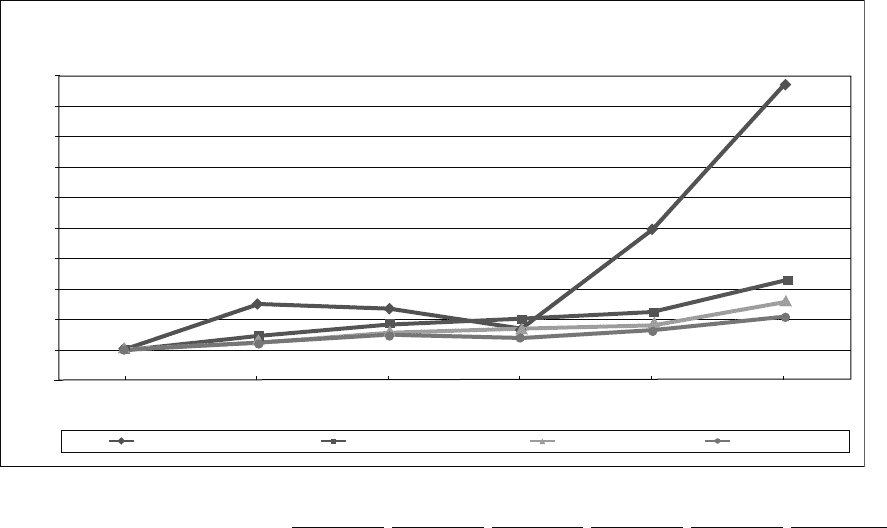

Performance Graph

The following graph compares the performance of our common stock during the period beginning

December 31, 2008 through December 31, 2013, to that of the total return index for the NYSE Composite, the

Dow Jones US Furnishings Index and the S&P SmallCap 600 Index (which includes Lumber Liquidators)

assuming an investment of $100 on December 31, 2008. In calculating total annual stockholder return,

reinvestment of dividends, if any, is assumed. The indices are included for comparative purpose only. They do

not necessarily reflect management’s opinion that such indices are an appropriate measure of the relative

performance of our common stock.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 2013

$1,000

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

Lumber Liquidators Holdings, Inc.

12/31/2008

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

Dow Jones US Furnishings Index S&P Smallcap 600 Index NYSE Composite

12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013

Lumber Liquidators Holdings, Inc . . $100.00 $253.79 $235.89 $167.23 $500.28 $974.34

Dow Jones US Furnishings Index . . $100.00 $143.58 $188.17 $198.61 $223.97 $330.18

S&P Smallcap 600 Index ........ $100.00 $125.57 $158.60 $160.22 $186.37 $263.37

NYSE Composite ............. $100.00 $128.95 $146.69 $141.46 $164.45 $207.85

25