Lumber Liquidators 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

NOTE 4. REVOLVING CREDIT AGREEMENT

A revolving credit agreement (the ‘‘Revolver’’) providing for borrowings up to $50,000 is available to

the Company through expiration on February 21, 2017. The Revolver is primarily available to fund inventory

purchases, including the support of up to $10,000 for letters of credit, and for general operations. As of

December 31, 2013, the Revolver supported $2,289 of letters of credit and there were no outstanding

borrowings against the Revolver. As of December 31, 2012, there were no outstanding commitments or

borrowings against the Revolver. The Revolver is secured by the Company’s inventory, has no mandated

payment provisions and a fee of 0.1% per annum, subject to adjustment based on certain financial

performance criteria, on any unused portion of the Revolver. Amounts outstanding under the Revolver would

be subject to an interest rate of LIBOR plus 1.125%, subject to adjustment based on certain financial

performance criteria. The Revolver has certain defined covenants and restrictions, including the maintenance

of certain defined financial ratios. The Company was in compliance with these financial covenants at

December 31, 2013.

NOTE 5. LEASES

The Company has operating leases for its stores, Corporate Headquarters, Hampton Roads and West

Coast distribution centers, supplemental office facilities and certain equipment. The store location leases are

operating leases and generally have five-year base periods with one or more five-year renewal periods. The

Corporate Headquarters has an operating lease with a base term running through December 31, 2019. The

Hampton Roads distribution centers have operating leases with varied expiration dates ending by March 31,

2015. The West Coast distribution center has an operating lease with a base term running through October 31,

2024.

As of December 31, 2013, 2012 and 2011, the Company leased the Corporate Headquarters, which

includes a store location, and 29, 27 and 25 of its locations, representing 9.4%, 9.7% and 9.5% of the total

number of store leases in operation, respectively, from entities controlled by the Company’s founder and

current chairman of the Board of Directors (‘‘Controlled Companies’’).

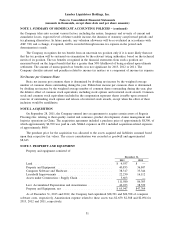

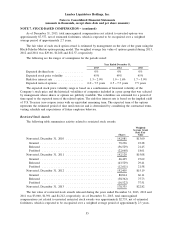

Rental expense is as follows:

Year Ended December 31,

2013 2012 2011

Rental expense ............................ $21,874 $18,826 $16,575

Rental expense related to Controlled Companies ..... 2,895 2,725 2,718

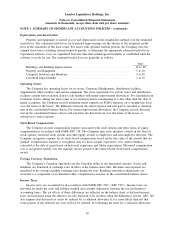

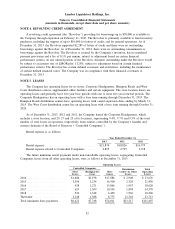

The future minimum rental payments under non-cancellable operating leases, segregating Controlled

Companies leases from all other operating leases, were as follows at December 31, 2013:

Operating Leases

Controlled Companies

Store

Leases

Distribution

Centers & Other

Leases

Total

Operating

Leases

Store

Leases

Headquarters

Lease

2014 ...................... $1,684 $1,198 $17,886 $ 2,908 $ 23,676

2015 ...................... 1,396 1,234 16,500 2,320 21,450

2016 ...................... 938 1,271 13,866 1,953 18,028

2017 ...................... 629 1,309 10,534 1,898 14,370

2018 ...................... 526 1,348 6,450 1,936 10,260

Thereafter .................. 1,248 1,388 8,775 12,302 23,713

Total minimum lease payments .... $6,421 $7,748 $74,011 $23,317 $111,497

52