Lumber Liquidators 2013 Annual Report Download - page 46

Download and view the complete annual report

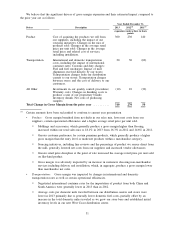

Please find page 46 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain External Factors and Events Impacting Our Business

Antidumping and Countervailing Duties Investigation. In October 2010, a conglomeration of domestic

manufacturers of multilayered wood flooring (the ‘‘Petitioner’’) filed a petition seeking the imposition of

antidumping (‘‘AD’’) and countervailing duties (‘‘CVD’’) with the United States Department of Commerce

(‘‘DOC’’) and the United States International Trade Commission (‘‘ITC’’) against imports of multilayered

wood flooring from China. The DOC then made preliminary determinations regarding CVD and AD rates in

March 2011 and May 2011, respectively. In fall 2011, after certain determinations were made by the ITC and

DOC, orders were issued setting final AD and CVD rates.

A number of appeals have been filed by several parties challenging various aspects of the determinations

made by both the ITC and DOC, including certain pending appeals that may impact the validity of the AD

and CVD orders and the applicable rates. Additionally, the DOC is in the process of finalizing the first annual

review of the AD and CVD rates. As part of that review process, such rates may be changed and applied

retroactively to the DOC’s preliminary determinations in the original investigation. The final results of the

first annual review of the AD and CVD rates are expected in March 2014 and May 2014, respectively.

A request for a second annual review of the AD and CVD rates has been submitted by the Petitioner.

Any change in the applicable rates as a result of the second annual review would apply to imports occurring

after the end of the first annual rate review period.

In 2013, approximately 15% of our flooring purchases were subject to AD and CVD. At this time, we are

unable to determine the positive or negative impact, if any, that the various appeals and rate reviews may have

on our business. See ‘‘Item 1A. Risk Factors — Risks Related to Our Suppliers, Products and Product

Sourcing.’’

Execution of Search Warrants. On September 26, 2013, sealed search warrants were executed at our

corporate offices in Toano and Richmond, Virginia by the Department of Homeland Security’s Immigration

and Customs Enforcement and the U.S. Fish and Wildlife Service. The search warrants requested information,

primarily documentation, related to the importation of certain of our wood flooring products. We continue to

cooperate with federal authorities to provide them with certain requested information.

Critical Accounting Policies and Estimates

Critical accounting policies are those that we believe are both significant and that require us to make

difficult, subjective or complex judgments, often because we need to estimate the effect of inherently uncertain

matters. We base our estimates and judgments on historical experiences and various other factors that we

believe to be appropriate under the circumstances. Actual results may differ from these estimates, and we

might obtain different estimates if we used different assumptions or conditions. We believe the following

critical accounting policies affect our more significant judgments and estimates used in the preparation of our

financial statements:

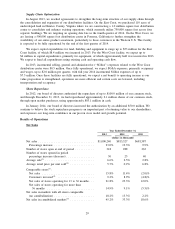

Recognition of Net Sales

We recognize net sales for products purchased at the time the customer takes possession of the

merchandise. We recognize service revenue, which consists primarily of installation revenue and freight

charges for in-home delivery, when the service has been rendered. We report sales exclusive of sales taxes

collected from customers and remitted to governmental taxing authorities. Net sales are reduced by an

allowance for anticipated sales returns that we estimate based on historical and current sales trends and

experience. We believe that our estimate for sales returns is an accurate reflection of future returns. Any

reasonably likely changes that may occur in the assumptions underlying our allowance estimates would not be

expected to have a material impact on our financial condition or operating performance. Actual sales returns

did not vary materially from estimated amounts for 2013, 2012 or 2011.

In addition, customers who do not take immediate delivery of their purchases are generally required to

pay a deposit, equal to approximately half of the retail sales value, with the balance payable when the

customer takes possession of the merchandise. These customer deposits benefit our cash flow and return on

investment capital, because we receive partial payment for our customers’ purchases immediately. We record

these deposits as a liability on our balance sheet in customer deposits and store credits until the customer

takes possession of the merchandise.

36