Lumber Liquidators 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

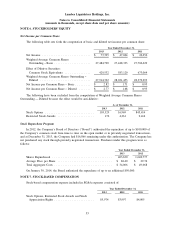

NOTE 7. STOCK-BASED COMPENSATION − (continued)

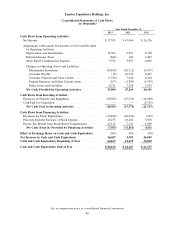

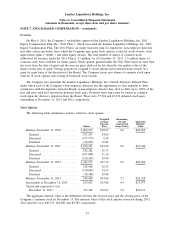

Stock Appreciation Rights

The following table summarizes activity related to SARs:

Shares

Weighted

Average

Exercise

Price

Remaining

Average

Contractual

Term (Years)

Aggregate

Intrinsic Value

Balance, December 31, 2011 ........ — $ — — $ —

Granted ..................... 9,796 24.71

Forfeited .................... (495) 24.35

Balance, December 31, 2012 ........ 9,301 $24.72 8.9 $261

Granted ..................... 7,533 71.84

Forfeited .................... (678) 57.95

Balance, December 31, 2013 ........ 16,156 $45.30 8.7 $938

Exercisable at December 31, 2013 .... 2,430 $29.34 8.3 $179

The fair value method, estimated by management using the Black-Scholes-Merton option pricing model,

is used to recognize compensation cost associated with SARs.

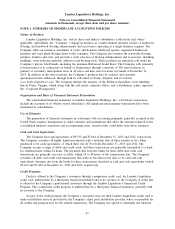

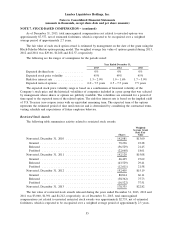

NOTE 8. INCOME TAXES

The components of income before income taxes were as follows:

Year Ended December 31,

2013 2012 2011

United States ............................. $128,482 $80,565 $45,259

Foreign ................................. (2,017) (2,079) (2,234)

Total Income before Income Taxes .............. $126,465 $78,486 $43,025

The provision for income taxes consists of the following:

Year Ended December 31,

2013 2012 2011

Current

Federal ............................... $43,159 $26,949 $12,291

State ................................. 6,637 4,195 2,063

Foreign ............................... 120 118 13

Total Current ............................. 49,916 31,262 14,367

Deferred

Federal ............................... (745) (387) 2,483

State ................................. (101) (164) 498

Foreign ............................... — 711 (579)

Total Deferred ............................ (846) 160 2,402

Total Provision for Income Taxes ............... $49,070 $31,422 $16,769

56