Lumber Liquidators 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

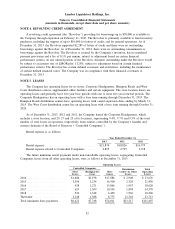

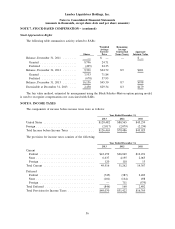

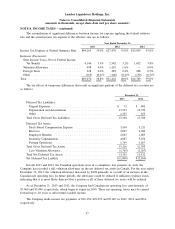

NOTE 8. INCOME TAXES − (continued)

The Company files income tax returns with the U.S. federal government and various state and foreign

jurisdictions. In the normal course of business, the Company is subject to examination by taxing authorities.

The Internal Revenue Service has completed audits of the Company’s federal income tax returns for years

through 2009.

On September 13, 2013, Treasury and the Internal Revenue Service issued final regulations regarding the

deduction and capitalization of expenditures related to tangible property. The final regulations under Internal

Revenue Code Sections 162, 167 and 263(a) apply to amounts paid to acquire, produce or improve tangible

property as well as dispositions of such property and are generally effective for tax years beginning on or after

January 1, 2014. The Company has evaluated these regulations and determined they will not have a material

impact on its consolidated results of operations, cash flows or financial position.

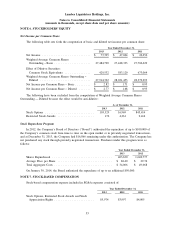

NOTE 9. PROFIT SHARING PLAN

The Company maintains a profit-sharing plan, qualified under Section 401(k) of the Internal Revenue

Code, for all eligible employees. Employees are eligible to participate following the completion of three

months of service and attainment of age 21. In 2013, the Company amended the plan to a safe harbor plan,

and began matching 100% of the first 3% of employee contributions and 50% of the next 2% of employee

contributions. Additionally, employees are now immediately 100% vested in the Company’s matching

contributions. Prior to 2013, the Company matched 50% of employee contributions up to 6% of eligible

compensation. The Company’s matching contributions, included in SG&A expenses, totaled $1,590, $749 and

$620 in 2013, 2012 and 2011, respectively.

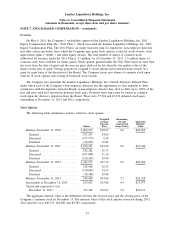

NOTE 10. RELATED PARTY TRANSACTIONS

The Company is party to an agreement dated June 1, 2010 with Designers’ Surplus, LLC t/a Cabinets to

Go (‘‘CTG’’). The Company’s founder is the sole member of an entity that owns a significant interest in CTG.

Pursuant to the terms of the agreement, the Company provides certain advertising, marketing and other

services. The Company charges CTG for its services at rates believed to be at fair market value. The revenue

recognized by the Company from this agreement was nil, $55 and $83 in 2013, 2012 and 2011, respectively.

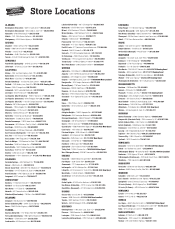

As described in Note 5, the Company leases a number of its store locations and Corporate Headquarters

from Controlled Companies.

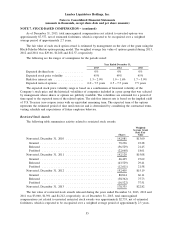

NOTE 11. COMMITMENTS AND CONTINGENCIES

On August 30, 2012, Jaroslaw Prusak, a purported customer (‘‘Prusak’’), filed a putative class action

lawsuit, which was subsequently amended, against the Company in the United States District Court for the

Northern District of Illinois. Prusak alleges that the Company willfully violated the Fair and Accurate Credit

Transactions Act amendments to the Fair Credit Reporting Act in connection with electronically printed credit

card receipts provided to certain of its customers. Prusak, for himself and the putative class, seeks statutory

damages of no less than $100 and no more than $1,000 per violation, punitive damages, attorney’s fees and

costs, and other relief. Prusak has filed a motion seeking certification of the putative class and the parties have

each filed motions seeking summary judgment with regard to matters at issue in the case. Those motions are

currently pending before the Court. Although the Company believes it has defenses to the claims asserted and

has opposed the motion to certify the class, no assurances can be given of any particular result. Given the

uncertainty inherent in any litigation, the current stage of the case and the legal standards that must be met

for, among other things, class certification and success on the merits, the Company cannot reasonably estimate

the possible loss or range of loss that may result from this action.

On or about November 26, 2013, Gregg Kiken (‘‘Kiken’’) filed a securities class action lawsuit, which

was subsequently amended, in the Federal District Court for the Eastern District of Virginia against the

Company, its founder, Chief Executive Officer and President, and Chief Financial Officer (collectively, the

58