Lumber Liquidators 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES − (continued)

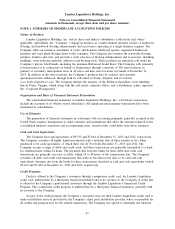

Depreciation and Amortization

Property and equipment is carried at cost and depreciated on the straight-line method over the estimated

useful lives. The estimated useful lives for leasehold improvements are the shorter of the estimated useful

lives or the remainder of the lease terms. For leases with optional renewal periods, the Company uses the

original lease term, excluding optional renewal periods, to determine the appropriate estimated useful lives.

Capitalized software costs are capitalized from the time that technological feasibility is established until the

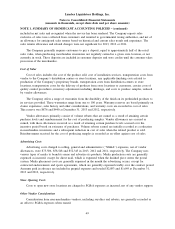

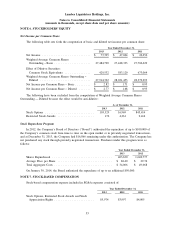

software is ready for use. The estimated useful lives are generally as follows:

Years

Buildings and Building Improvements ................................ 15to40

Property and Equipment ......................................... 5to10

Computer Software and Hardware ................................... 3to10

Leasehold Improvements ......................................... 1to15

Operating Leases

The Company has operating leases for its stores, Corporate Headquarters, distribution facilities,

supplemental office facilities and certain equipment. The lease agreements for certain stores and distribution

facilities contain rent escalation clauses, rent holidays and tenant improvement allowances. For scheduled rent

escalation clauses during the lease terms or for rental payments commencing at a date other than the date of

initial occupancy, the Company records minimum rental expenses in SG&A expenses on a straight-line basis

over the terms of the leases. The difference between the rental expense and rent paid is recorded as deferred

rent in the consolidated balance sheets. For tenant improvement allowances, the Company records deferred

rent in the consolidated balance sheets and amortizes the deferred rent over the terms of the leases as

reductions to rental expense.

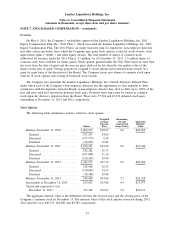

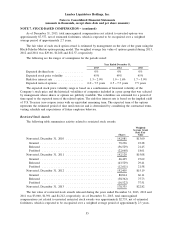

Stock-Based Compensation

The Company records compensation expense associated with stock options and other forms of equity

compensation in accordance with FASB ASC 718. The Company may issue incentive awards in the form of

stock options, restricted stock awards and other equity awards to employees and non-employee directors. The

Company recognizes expense for its stock-based compensation based on the fair value of the awards that are

granted. Compensation expense is recognized only for those awards expected to vest, with forfeitures

estimated at the date of grant based on historical experience and future expectations. Measured compensation

cost is recognized ratably over the requisite service period of the entire related stock-based compensation

award.

Foreign Currency Translation

The Company’s Canadian operations use the Canadian dollar as the functional currency. Assets and

liabilities are translated at exchange rates in effect at the balance sheet date. Revenues and expenses are

translated at the average monthly exchange rates during the year. Resulting translation adjustments are

recorded as a component of accumulated other comprehensive income on the consolidated balance sheets.

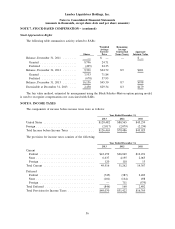

Income Taxes

Income taxes are accounted for in accordance with FASB ASC 740 (‘‘ASC 740’’). Income taxes are

provided for under the asset and liability method and consider differences between the tax and financial

accounting bases. The tax effects of these differences are reflected on the balance sheet as deferred income

taxes and measured using the effective tax rate expected to be in effect when the differences reverse. ASC 740

also requires that deferred tax assets be reduced by a valuation allowance if it is more likely than not that

some portion of the deferred tax asset will not be realized. In evaluating the need for a valuation allowance,

50