Lumber Liquidators 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

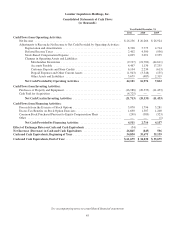

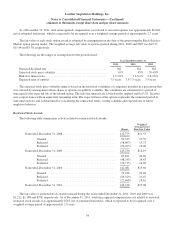

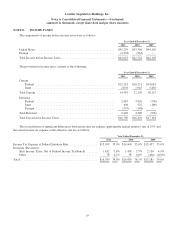

NOTE 8. INCOME TAXES

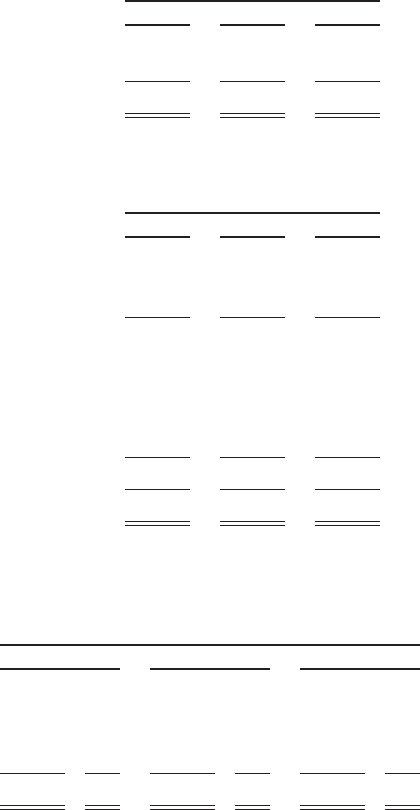

The components of income before income taxes were as follows:

Year Ended December 31,

2011 2010 2009

United States ..................................................... $45,259 $43,306 $44,105

Foreign .......................................................... (2,234) (564) —

Total Income before Income Taxes .................................... $43,025 $42,742 $44,105

The provision for income taxes consists of the following:

Year Ended December 31,

2011 2010 2009

Current

Federal ...................................................... $12,291 $10,231 $14,681

State ........................................................ 2,076 1,945 3,456

Total Current ..................................................... 14,367 12,176 18,137

Deferred

Federal ...................................................... 2,483 3,926 (776)

State ........................................................ 498 522 (180)

Foreign ...................................................... (579) (148) —

Total Deferred .................................................... 2,402 4,300 (956)

Total Provision for Income Taxes ..................................... $16,769 $16,476 $17,181

The reconciliation of significant differences between income tax expense applying the federal statutory rate of 35% and

the actual income tax expense at the effective rate are as follows:

Year Ended December 31,

2011 2010 2009

Income Tax Expense at Federal Statutory Rate ................... $15,059 35.0% $14,960 35.0% $15,437 35.0%

Increases (Decreases):

State Income Taxes, Net of Federal Income Tax Benefit ....... 1,632 3.8% 1,478 3.5% 2,150 4.9%

Other ................................................ 78 0.2% 38 0.0% (406) (0.9%)

Total .................................................... $16,769 39.0% $16,476 38.5% $17,181 39.0%

55