Lumber Liquidators 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

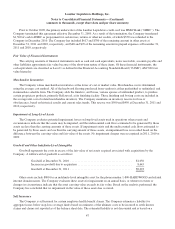

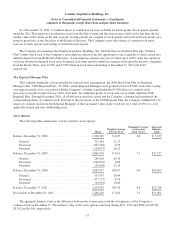

The purchase price for the acquisition was allocated to the assets acquired and liabilities assumed based upon their

respective fair values. The excess consideration was recorded as goodwill and approximated $8,643, of which all is

deductible for tax purposes. Goodwill represents future economic benefits arising from other assets acquired that could not

be individually identified including workforce additions, growth opportunities and direct servicing of mill relationships.

Other liabilities primarily consist of reserves for warranty claims related to mills previously managed by Sequoia. The total

purchase price has been allocated to the net tangible and intangible assets as follows:

Property and Equipment ................................................ $ 97

Other Assets .......................................................... 170

Other Liabilities ....................................................... (427)

Goodwill ............................................................ 8,643

Fair Value of Purchase Consideration ...................................... $8,483

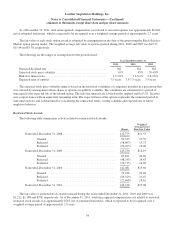

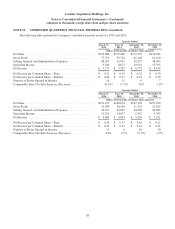

NOTE 4. PROPERTY AND EQUIPMENT

Property and equipment consisted of:

December 31,

2011 2010

Property and Equipment .............................................. $31,411 $25,314

Computer Software and Hardware ...................................... 29,680 23,838

Leasehold Improvements ............................................. 12,672 9,092

73,763 58,244

Less: Accumulated Depreciation and Amortization ........................ 29,616 22,930

Property and Equipment, net ...................................... $44,147 $35,314

Computer software and hardware costs capitalized of $19,544 and $15,225 relates to the Company’s integrated

information technology solution as of December 31, 2011 and 2010, respectively. Amortization expense related to these

assets was $1,795 and $500 for 2011 and 2010, respectively.

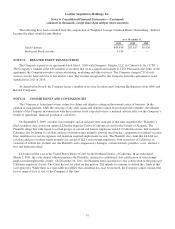

NOTE 5. REVOLVING CREDIT AGREEMENT

A revolving credit agreement (the “Revolver”) providing for borrowings up to $25,000 is available to LLI through

expiration on August 10, 2012. During 2011 and 2010, LLI did not borrow against the Revolver and at December 31, 2011

and 2010, there were no outstanding commitments under letters of credit. The Revolver is primarily available to fund

inventory purchases, including the support of up to $5,000 for letters of credit, and for general operations. The Revolver is

secured by LLI’s inventory, has no mandated payment provisions and a fee of 0.125% per annum, subject to adjustment

based on certain financial performance criteria, on any unused portion of the Revolver. Amounts outstanding under the

Revolver would be subject to an interest rate of LIBOR (reset on the 10th of the month) plus 0.50%, subject to adjustment

based on certain financial performance criteria. The Revolver has certain defined covenants and restrictions, including the

maintenance of certain defined financial ratios. LLI was in compliance with these financial covenants at December 31, 2011.

Subsequent to December 31, 2011, the Company amended the Revolver (the “Amended Revolver”) to provide for

borrowings up to $50,000 through expiration in February 2017. The Amended Revolver is secured by LLI’s inventory,

supports up to $10,000 in letters of credit, has no mandated payment provisions and a fee of 0.1% per annum, subject to

adjustment based on certain financial performance criteria, on any unused portion of the Amended Revolver. Amounts

outstanding under the Amended Revolver would be subject to an interest rate of LIBOR plus 1.125%, subject to adjustment

based on certain financial performance criteria. The Amended Revolver has certain defined covenants and restrictions,

including the maintenance of certain defined financial ratios.

51