Lumber Liquidators 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

As of December 31, 2011, 1.8 million shares of common stock were available for future grants. Stock options granted

under the 2011 Plan expire no later than ten years from the date of grant and the exercise price shall not be less than the fair

market value of the shares on the date of grant. Vesting periods are assigned to stock options and restricted stock awards on a

grant by grant basis at the discretion of the Board of Directors. The Company issues new shares of common stock upon

exercise of stock options and vesting of restricted stock awards.

The Company also maintains the Lumber Liquidators Holdings, Inc. Outside Directors Deferral Plan (the “Deferral

Plan”) under which each of the Company’s non-employee directors has the opportunity to elect annually to defer certain fees

until his departure from the Board of Directors. A non-employee director may elect to defer up to 100% of his fees and have

such fees invested in deferred stock units. Deferred stock units must be settled in common stock upon the director’s departure

from the Board. There were 32,960 and 22,265 deferred stock units outstanding at December 31, 2011 and 2010,

respectively.

The Regional Manager Plan

The Company maintains a stock unit plan for regional store management, the 2006 Stock Unit Plan for Regional

Managers (the “2006 Regional Plan”). In 2006, certain Regional Managers were granted a total of 85,000 stock units vesting

over approximately a five year period with the Company’s founder contributing the 85,000 shares of common stock

necessary to provide for the exercise of the stock units. No additional grants of stock units are available under the 2006

Regional Plan. Through December 2010, all 85,000 stock units had vested and the Company’s founder had transferred the

corresponding shares of common stock. Pursuant to the provisions of the 2006 Regional Plan, the Company withheld 20,134

shares of common stock from the Regional Managers at the fair market value on the vest dates for a total of $354, to cover

applicable federal and state withholding taxes.

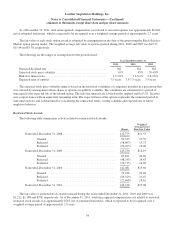

Stock Options

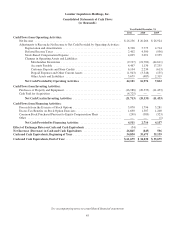

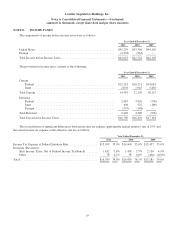

The following table summarizes activity related to stock options:

Shares

Weighted Average

Exercise Price

Remaining Average

Contractual

Term (Years)

Aggregate

Intrinsic

Value

Balance, December 31, 2008 ............................ 2,226,107 $ 8.27 8.0 $ 5,199

Granted ......................................... 317,141 11.17

Exercised ....................................... (393,199) 8.35

Forfeited ........................................ (103,073) 10.22

Balance, December 31, 2009 ............................ 2,046,976 $ 8.61 7.2 $37,237

Granted ......................................... 289,026 24.35

Exercised ....................................... (206,821) 8.68

Forfeited ........................................ (59,664) 13.24

Balance, December 31, 2010 ............................ 2,069,517 $10.67 6.6 $29,635

Granted ......................................... 557,557 24.64

Exercised ....................................... (377,775) 8.14

Forfeited ........................................ (54,952) 19.82

Balance, December 31, 2011 ............................ 2,194,347 $14.42 6.6 $12,746

Exercisable at December 31, 2011 ........................ 1,268,429 $ 8.82 5.1 $11,491

The aggregate intrinsic value is the difference between the exercise price and the closing price of the Company’s

common stock on December 31. The intrinsic value of the stock options exercised during 2011, 2010 and 2009 was $5,583,

$3,742 and $4,380, respectively.

53