Lumber Liquidators 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

April 5, 2012

Dear Shareholders,

We are pleased to have steadily regained momentum throughout 2011, ending the year on a strong note and achieving

our best year-over-year net sales and earnings performance in the fourth quarter. Similar to 2010, our results were a tale of

two halves, and as the year progressed, we focused intently on executing our strategic initiatives and improving performance

across all areas of our business. We believe we strengthened our unique value proposition of price, selection, quality,

availability and people, and we established a strong platform for multi-year growth.

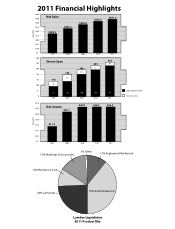

2011 Financial Highlights

During 2011, our strategic initiatives, including those in sourcing, drove an expansion in our second half operating

margin. While the macroeconomic environment remained challenging with consumers continuing to be cautious and price

sensitive with regard to large-ticket discretionary purchases, we drove positive traffic throughout the year, and in the fourth

quarter of 2011, traffic was positive at comparable stores. Further, we continued to gain market share in our highly

fragmented wood flooring market, primarily through new store openings. Specifically, for the full year we reported:

• Net sales growth of 9.9% to $681.6 million;

• Gross margin expansion of 50 basis points to 35.3%;

• Operating margin of 6.2%; and

• Fully diluted earnings per share of $0.93.

Positioning Lumber Liquidators for the Future

2011 was a year of transformation for Lumber Liquidators, as we continued to make investments in leadership,

infrastructure and store growth with the goal of further strengthening our position in the marketplace. We also took steps to

further enhance our value proposition and improve our connection to consumers.

•Further Strengthened Management Team. Our ability to grow effectively is directly related to our strong

management team. During the year, Bill Schlegel and Carl Daniels joined the Company as Chief Merchandising

Officer and Senior Vice President of Supply Chain, respectively. Both individuals bring invaluable experience to

our organization, and have aided us in improving our execution in merchandising, sourcing and supply chain

management. We made additional investments in both our merchandising team and a seasoned product allocation

team, supported by enhanced visibility into our operations as a result of our integrated information technology

solution. We will continue to make investments in the development of a world-class team, which is a critical

component of our value proposition.

•Improved Sourcing Capabilities. We further laid the foundation for the Company’s long-term success by

implementing various sourcing initiatives to improve our vendor relationships. We also completed the acquisition

of certain assets of Sequoia Floorings, strengthening our direct relationships with mills in China and allowing us to

more efficiently and effectively control the quality and costs of products sourced in this region. Our sourcing

initiatives enabled us to strengthen our value proposition and provided us with greater flexibility in our marketing

programs, helping us to attract value conscious consumers, while at the same time allowing us to expand gross

margin. We will continue to execute the strategy we have pursued over the last year – conducting line reviews and

expanding our product assortment – and we expect to further leverage our China office.