Lumber Liquidators 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

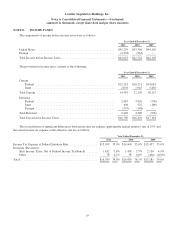

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax

position will be sustained on examination by the relevant taxing authorities, based on the technical merits of its position. The

tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a

greater than 50% likelihood of being realized upon ultimate settlement. The amount of unrecognized tax benefits was not

significant for 2011, 2010 or 2009. The Company classifies interest and penalties related to income tax matters as a

component of income tax expense.

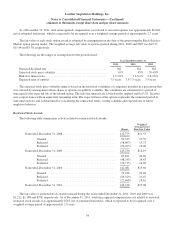

Net Income per Common Share

Basic net income per common share is determined by dividing net income by the weighted average number of common

shares outstanding during the year. Diluted net income per common share is determined by dividing net income by the

weighted average number of common shares outstanding during the year, plus the dilutive effect of common stock

equivalents, including stock options and restricted stock awards. Common stock and common stock equivalents included in

the computation represent shares issuable upon assumed exercise of outstanding stock options and release of restricted stock

awards, except when the effect of their inclusion would be antidilutive.

Recent Accounting Pronouncements

In September 2011, the FASB issued guidance that revises the requirements around how entities test goodwill for

impairment. The guidance allows companies to perform a qualitative assessment before calculating the fair value of the

reporting unit. If entities determine, on the basis of qualitative factors, that the fair value of the reporting unit is more likely

than not greater than the carrying amount, a quantitative calculation would not be needed. The Company will adopt this

guidance for its fiscal 2012 annual goodwill impairment test.

In June 2011, the FASB issued guidance that revises the manner in which entities present comprehensive income in

their financial statements. The guidance requires entities to report the components of comprehensive income in either a

single, continuous statement or two separate but consecutive statements. The Company early adopted this guidance for its

fiscal 2011 financial statements, and has presented the components of comprehensive income in a separate but consecutive

statement.

NOTE 2. NOTES RECEIVABLE

As of December 31, 2011, notes receivable from a merchandise vendor had an outstanding balance due to the Company

of $696, of which $322 had been included in other current assets. As of December 31, 2010, the outstanding balance due to

the Company was $867, of which $322 had been included in other current assets.

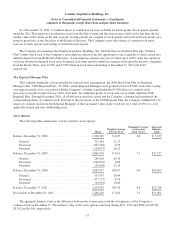

NOTE 3. ACQUISITION

On September 28, 2011, the Company entered into an agreement to acquire certain assets of Sequoia Floorings Inc.

(“Sequoia”) relating to Sequoia’s quality control and assurance, product development, claims management and logistics

operations in China. In connection with the agreement, the Company retained certain key Sequoia personnel in Shanghai,

China and assumed direct control of sourcing previously managed by Sequoia. Sequoia, a trading company, provided

sourcing services on approximately 78% of the Company’s 2011 merchandise purchases from Asia, which represented

approximately one-third of the Company’s total 2011 merchandise purchases. The acquisition strengthens the Company’s

mill direct relationships pursuant to its long-term sourcing strategy, and allows for a coordinated and efficient transition to

direct servicing of mill relationships by an experienced team of quality and product development experts. As part of the

transaction, the Company established a representative office in Shanghai.

The acquisition agreement included a purchase price of approximately $8,300, of which approximately $4,700 was paid

in cash. SG&A in 2011 included acquisition-related expenses of approximately $600.

50