Logitech 2014 Annual Report Download - page 292

Download and view the complete annual report

Please find page 292 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

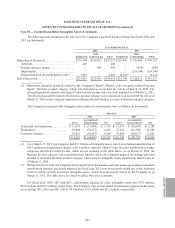

defined benefit pension plans caused by the number of plan participants affected by this restructuring, which was

not included in the restructuring charges since it related to prior services. The Company substantially completed

this restructuring plan by the fourth quarter of fiscal year 2014.

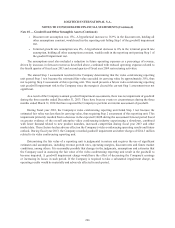

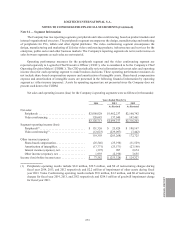

During the first quarter of fiscal year 2013, the Company implemented a restructuring plan to simplify its

organization, better align its costs with its current business and to free up resources to pursue growth opportunities.

A majority of the restructuring activity was completed during the first quarter of fiscal year 2013. As part of

this restructuring plan, the Company reduced its worldwide non-direct labor workforce. During fiscal year 2013,

restructuring charges under this plan included $25.9 million in termination benefits, $1.3 million in legal, consulting,

and other costs as a result of the terminations, and $1.3 million in lease exit costs associated with the closure

of existing facilities. Termination benefits are calculated based on regional benefit practices and local statutory

requirements. In addition, charges of $3.0 million related to the discontinuance of certain product development

efforts were included in cost of goods sold and a $2.2 million charge from the re-measurement of its Swiss defined

benefit pension plan caused by the number of plan participants affected by this restructuring, which was not

included in the restructuring charges since it related to prior services. The Company substantially completed this

restructuring plan by the fourth quarter of fiscal year 2013.

Termination benefits were calculated based on regional benefit practices and local statutory requirements.

Lease exit costs primarily relate to costs associated with the closure of existing facilities. Other charges primarily

consist of legal, consulting and other costs related to employee terminations.

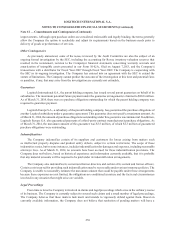

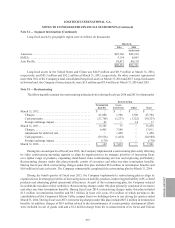

Note 16 — Subsequent events

Repurchase of ESPP Awards

The Company was not current with its periodic reports required to be filed with the SEC and was therefore

unable to issue any shares under its Registration Statements on Form S-8 after July 31, 2014. Given the proximity

of the unavailability of those registration statements and the end of the current ESPP offering period, also on

July 31, 2014, the Compensation Committee authorized the termination of the current ESPP offering period and

a one-time payment to each participant in an amount equal to the fifteen percent (15%) discount at which shares

would otherwise have been repurchased pursuant to the current period of the ESPPs. This one-time payment was

accounted for as a repurchase of equity awards that reduced additional paid-in capital, resulting in no additional

compensation cost. Given the unavailability of the Company’s Registration Statements on Form S-8, no new ESPP

offering periods were initiated since July 31, 2014.

Dividend

On November 12, 2014, the Board approved, subject to approval by the Company’s shareholders and other

Swiss statutory requirements, a dividend of CHF 0.2625 per share.

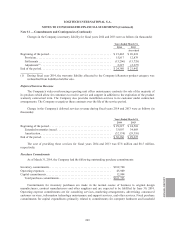

Note 17 — Other Disclosures Required by Swiss Law

Balance Sheet Items

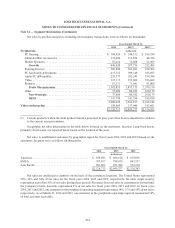

The amounts of certain balance sheet items were as follows (in thousands):

March 31,

2014 2013

Prepayments and accrued income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,681 $ 11,613

Non-current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $518,390 $535,570

Pension liabilities, current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,100 $ 994

Fire insurance value of property, plant and equipment . . . . . . . . . . . . . . . . . $214,020 $210,627

Note 15 — Restructuring (Continued)

276