Logitech 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308

|

|

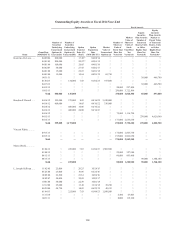

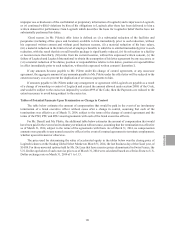

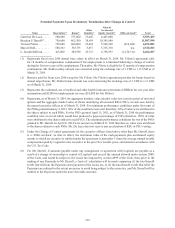

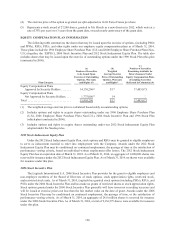

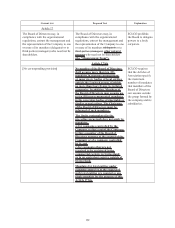

Potential Payments Upon Involuntary Termination After Change in Control

Name Base Salary(1) Bonus(2)

Other

Benefits(3)

Value of

Accelerated

Equity Awards(4) 280G cut-back(5) Total

Guerrino De Luca ..... 500,000 575,000 13,465 4,467,000 — 5,555,465

Bracken P. Darrell(6) ... 750,000 862,500 30,419 10,345,080 — 11,987,999

Vincent Pilette ....... 750,000 600,000 23,465 5,509,300 (610,682 ) 6,072,083

Marcel Stolk ......... 580,363 583,753 8,657 3,355,330 n/a 4,528,103

L. Joseph Sullivan ..... 415,000 385,950 22,713 2,796,955 (1,156,511) 2,464,107

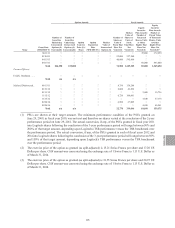

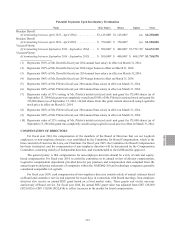

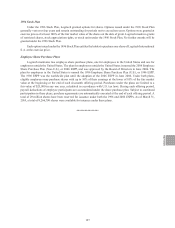

(1) Represents fiscal year 2014 annual base salary in effect on March 31, 2014. Mr. Pilette’s agreement calls

for 18 months of compensation continuation if his employment is terminated following a change of control

during the first two years of his employment. Thereafter, Mr. Pilette is eligible for 12 months of compensation

continuation. Mr. Stolk’s salary amount was converted using the exchange rate of 1 CHF to 1.13 USD as of

March 31, 2014.

(2) Bonuses paid for fiscal year 2014 except for Mr. Pilette. Mr. Pilette’s agreement provides for bonus based on

annual target bonus. Mr. Stolk’s bonus amount was converted using the exchange rate of 1 CHF to 1.13 USD

as of March 31, 2014.

(3) Represents the estimated cost of medical and other health insurance premiums (COBRA) for one year after

termination and $5,000 in outplacement services ($15,000 for Mr. Pilette).

(4) Represents, as of March 31, 2014, the aggregate intrinsic value (market value less exercise price) of unvested

options and the aggregate market value of shares underlying all unvested RSUs PSUs, in each case held by

the named executive officer as of March 31, 2014. For minimum performance conditions under the terms of

the PSOs granted January 4, 2013, 50% of the conditions were met therefore, 50% of value were attributed to

the shares subject to such PSOs. For the PSUs granted April 15, 2013, as of March 31, 2014 the performance

condition were at a level which would have produced a payout percentage of 150% therefore, 150% of value

were attributed to the shares subject to such PSUs. The minimum performance conditions for two of the PSOs

granted to Mr. Darrell on April 16, 2012 were not met as of March 31, 2014 therefore no value were attributed

to the shares subject to such PSOs. Mr. De Luca does not receive any acceleration of RSU or PSU vesting.

(5) Under the Change of Control agreements for the executive officers listed above other than Mr. Darrell, there

is a “280G cut-back” so that, in effect, the maximum value of the cash payments plus accelerated equity

awards to which an executive is entitled under the agreement is just under 3 times the average annual taxable

compensation paid by Logitech to the executive in the prior five taxable years, calculated in accordance with

the U.S. Tax Code.

(6) For Mr. Darrell, if amounts payable under any arrangement or agreement with Logitech are payable as a

result of a change of ownership or control of Logitech and exceed the amount allowed under section 280G

of the Code, and would be subject to the excise tax imposed by section 4999 of the Code, then, prior to the

making of any Payments to Mr. Darrell, a “best-of” calculation will be made comparing (1) the total benefit

to Mr. Darrell from the Payments after payment of the excise tax, to (2) the total benefit to Mr. Darrell if the

Payments are reduced to the extent necessary to avoid being subject to the excise tax, and Mr. Darrell will be

entitled to the Payments under the more favorable outcome.

122