Logitech 2014 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

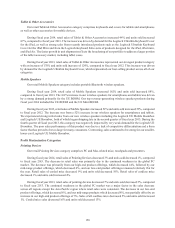

Impairment of Goodwill and Other Assets

There was no impairment of goodwill and other assets for fiscal year 2014. We recorded an impairment

charge of goodwill and other assets of $216.7 million primarily related to the Lifesize business in fiscal year 2013.

While performing our annual goodwill impairment analysis of each of our reporting units as of December 31,

2012, we determined that our video conferencing reporting unit’s estimated fair value was less than its carrying

value, thus requiring a Step 2 assessment of this reporting unit. This impairment primarily resulted from a decrease

in our expected CAGR during the assessment forecast period based on greater evidence of the overall enterprise

video conferencing industry experiencing a slowdown in recent quarters, combined with lower demand related to

new product launches, increased competition in fiscal year 2013 and other market data. The Step 2 test required us

to fair value all assets and liabilities of our video conferencing reporting unit to determine the implied fair value

of this reporting unit’s goodwill. We were unable to complete the Step 2 analysis prior to filing of our Form 10-Q

for the quarterly period ended December 31, 2012 due to the complexities of determining the implied fair value

of goodwill of our video conferencing reporting unit. Based on our work performed during the third quarter of

fiscal year 2013, we initially recorded an estimated goodwill impairment charge of $211.0 million. During the

fourth quarter of fiscal year 2013, we completed this goodwill impairment assessment and recorded an additional

$3.5 million in goodwill impairment charge related to our video conferencing reporting unit. During the fourth

quarter of fiscal year 2013, we also recorded impairment charges of $2.1 million related to our digital video security

product line, included within our retail video product category, which we plan to divest.

Restructuring Charges

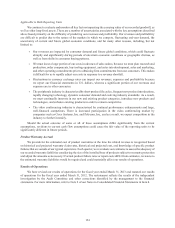

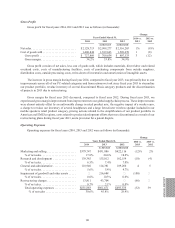

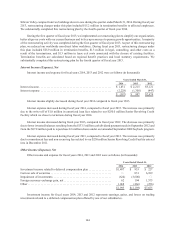

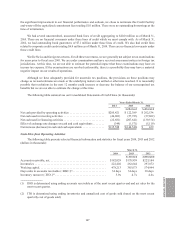

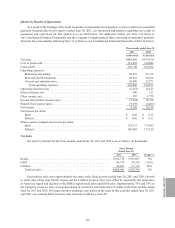

Our restructuring activities were mainly attributable to the peripherals operating segment. The following

table summarizes restructuring-related activities during the years ended March 31, 2014 and 2013 (in thousands):

Restructuring

Termination

Benefits

Lease Exit

Costs Other Total

March 31, 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $ —

Charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,088 1,308 1,308 43,704

Cash payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (27,768) (1,233) (1,322) (30,323)

Foreign exchange impact . . . . . . . . . . . . . . . . . . . . . . . . 63 — 14 77

March 31, 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,383 75 — 13,458

Charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,463 7,348 — 13,811

Adjustment for deferred rent . . . . . . . . . . . . . . . . . . . . . — 1,450 — 1,450

Cash payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (19,534) (1,454) — (20,988)

Foreign exchange impact . . . . . . . . . . . . . . . . . . . . . . . . (170) — — (170)

March 31, 2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 142 $ 7,419 $ — $ 7,561

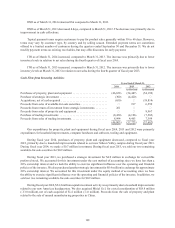

During the second quarter of fiscal year 2014, we implemented a restructuring plan solely affecting our video

conferencing operating segment to align its organization to its strategic priorities of increasing focus on a tighter

range of products, expanding cloud-based video conferencing services and improving profitability. Restructuring

charges under this plan primarily consist of severance and other one-time termination benefits. During fiscal year

2014, restructuring charges under this plan included $5.0 million in termination benefits and $0.6 million in lease

exit costs. We substantially completed this restructuring plan by March 31, 2014.

During the fourth quarter of fiscal year 2013, we implemented a restructuring plan to align our organization

to our strategic priorities of increasing focus on mobility products, improving profitability in PC-related products

and enhancing global operational efficiencies. As part of this restructuring plan, we reduced our worldwide

non-direct labor workforce. Restructuring charges under this plan primarily consisted of severance and other

one-time termination benefits. During fiscal year 2014, restructuring charges under this plan included $1.5 million

in termination benefits and $6.7 million in lease exit costs, $5.4 million of which pertains to the consolidation our

ANNUAl REPORT

163