Logitech 2014 Annual Report Download - page 260

Download and view the complete annual report

Please find page 260 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 3 — Summary of Significant Accounting Policies (Continued)

Restructuring Charges

The Company’s restructuring charges consist of employee severance, one-time termination benefits and

ongoing benefits related to the reduction of its workforce, lease exit costs, and other costs. Liabilities for costs

associated with a restructuring activity are measured at fair value and are recognized when the liability is incurred,

as opposed to when management commits to a restructuring plan. One-time termination benefits are expensed

at the date the entity notifies the employee, unless the employee must provide future service, in which case the

benefits are expensed ratably over the future service period. Ongoing benefits are expensed when restructuring

activities are probable and the benefit amounts are estimable. Costs to terminate a lease before the end of its term

are recognized when the property is vacated. Other costs primarily consist of legal, consulting, and other costs

related to employee terminations and are expensed when incurred. Termination benefits are calculated based on

regional benefit practices and local statutory requirements.

Recent Accounting Pronouncements

In July 2013, the FASB issued Accounting Standards Update (“ASU”) No. 2013-11, Presentation of

an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists. This ASU provides explicit guidance on the financial statement presentation of an

unrecognized tax benefit when a net operating loss carryforward, a similar tax loss, or a tax credit carryforward

exists. ASU No. 2013-11 is effective for interim and annual periods beginning after December 15, 2013 and was

effective for the Company in the first quarter of fiscal 2015.

In May 2014, the FASB issued Accounting Standards Update No. 2014-09, “Revenue from Contracts with

Customers (Topic 606),” (“ASU 2014-09”). ASU 2014-09 outlines a new, single comprehensive model for entities to

use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition

guidance, including industry- specific guidance. This new revenue recognition model provides a five-step analysis

in determining when and how revenue is recognized. The new model will require revenue recognition to depict the

transfer of promised goods or services to customers in an amount that reflects the consideration a company expects

to receive in exchange for those goods or services. The new standard will be effective for the Company beginning

April 1, 2017. Early application is prohibited. The Company is currently evaluating the impact that adopting this

new accounting guidance will have on its consolidated financial statements.

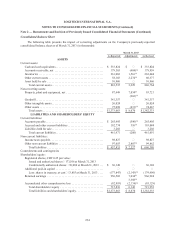

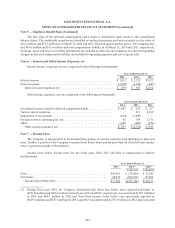

Note 4 — Net Income (Loss) per Share

The computations of basic and diluted net income (loss) per share for the Company were as follows

(in thousands except per share amounts):

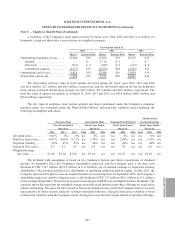

Years Ended March 31,

2014 2013 2012

As Revised As Restated

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 74,304 $(227,518) $104,237

Shares used in net income (loss) per share computation:

Weighted average shares outstanding—basic . . . . . . . . . . . . . . . . . . 160,619 158,468 174,648

Effect of potentially dilutive equivalent shares . . . . . . . . . . . . . . . . . 1,907 — 943

Weighted average shares outstanding—diluted. . . . . . . . . . . . . . 162,526 158,468 175,591

Net income (loss) per share:

Basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.46 $ (1.44) $ 0.60

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.46 $ (1.44) $ 0.59

244