Logitech 2014 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2014 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308

|

|

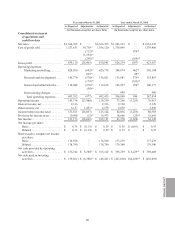

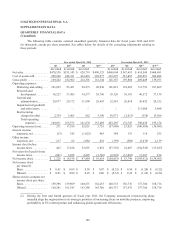

(2) Impairment of goodwill and other assets during the third quarter of fiscal year 2013 was due to an estimated

$211.0 million goodwill impairment charge related to the video conferencing reporting unit.

(3) Impairment of goodwill and other assets during the fourth quarter of fiscal year 2013 was due to an additional

$3.5 million in goodwill impairment charge related to the video conferencing reporting unit and $2.2 million

in impairment charges related to the digital video security product line.

(4) Basic and diluted earnings per share are computed independently for each of the quarters presented. Therefore,

the sum of quarterly basic and diluted per share information may not equal annual basic and diluted earnings

per share.

(5) During the quarter ended September 30, 2013, the Company implemented a restructuring plan solely affecting

the video conferencing operating segment to align its organization to its strategic priorities of increasing focus

on a tighter range of products, expanding cloud-based video conferencing services and improving profitability.

(6) The Company incurred $5.4 million of restructuring charges related to lease exit costs which pertains to

the consolidation our Silicon Valley campus from two buildings down to one during the quarter ended

March 31, 2014.

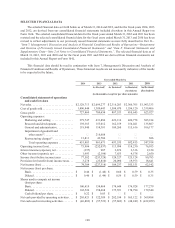

Consolidated Statements of Operations.

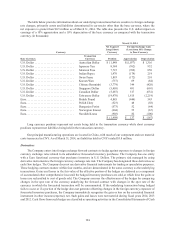

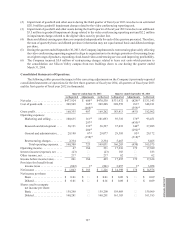

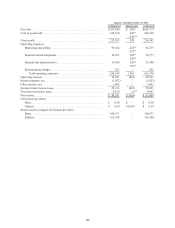

The following tables present the impact of the correcting adjustments on the Company’s previously-reported

consolidated statements of operations for the first three quarters of fiscal year 2014, all quarters of fiscal year 2013

and the first quarter of fiscal year 2012 (in thousands):

Quarter ended June 30, 2013 Quarter ended September 30, 2013

As Reported Adjustments As Revised As Reported Adjustments As Revised

Net sales . . . . . . . . . . . . . . . . . . . . . $477,924 $ 606(4) $478,530 $ 531,972 $ (829)(4) $ 531,143

Cost of goods sold . . . . . . . . . . . . . . 309,569 165(2) 309,268 348,559 181(2) 348,181

(466)(4) (559)(4)

Gross profit . . . . . . . . . . . . . . . . . . . 168,355 907 169,262 183,413 (451) 182,962

Operating expenses:

Marketing and selling . . . . . . . . 100,635 161(2) 101,093 93,710 176(2) 93,451

297(4) (435)(4)

Research and development . . . . 36,191 132(2) 36,527 37,633 144(2) 37,485

204(4) (292)(4)

General and administrative . . . . 29,148 87(2) 29,077 29,395 95(2) 29,172

(158)(4) (318)(4)

Restructuring charges . . . . . . . . 2,334 — 2,334 5,465 — 5,465

Total operating expenses . . . 168,308 723 169,031 166,203 (630) 165,573

Operating income . . . . . . . . . . . . . . 47 184 231 17,210 179 17,389

Interest income (expense), net . . . . (23) — (23) 183 — 183

Other income, net . . . . . . . . . . . . . . 217 — 217 62 — 62

Income before income taxes . . . . . . 241 184 425 17,455 179 17,634

Provision for (benefit from)

income taxes . . . . . . . . . . . . . . . (802) 1(4) (801) 3,057 1(4) 3,058

Net income . . . . . . . . . . . . . . . . . . . $ 1,043 $ 183 $ 1,226 $ 14,398 $ 178 $ 14,576

Net income per share:

Basic . . . . . . . . . . . . . . . . . . . . . $ 0.01 $ — $ 0.01 $ 0.09 $ — $ 0.09

Diluted . . . . . . . . . . . . . . . . . . . . $ 0.01 $ — $ 0.01 $ 0.09 $ — $ 0.09

Shares used to compute

net income per share:

Basic . . . . . . . . . . . . . . . . . . . . . 159,298 — 159,298 159,969 — 159,969

Diluted . . . . . . . . . . . . . . . . . . . . 160,281 — 160,281 161,183 — 161,183

ANNUAl REPORT

197