Konica Minolta 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Millions of yen

Thousands of

U.S. dollars

(Note 1)

2009 2008 2009

For the Year:

Net sales ¥947,843 ¥1,071,568 $9,649,221

Operating income 56,260 119,606 572,737

Net income 15,179 68,829 154,525

Capital expenditure 61,164 75,295 622,661

R&D costs 81,904 81,370 833,798

At Year-End:

Total assets ¥918,058 ¥970,538 $9,346,004

Total net assets 414,284 418,310 4,217,490

Yen

U.S. dollars

(Note 1)

Per Share of Common Stock:

Net income—basic ¥ 28.62 ¥129.71 $0.29

Net assets 779.53 786.20 7.94

Cash dividends 20 15 0.20

Percent

Financial Ratios (Note 2):

Equity ratio 45.0% 43.0%

Return on assets 6.2 12.7

Return on equity 3.7 17.5

Profile

Notes: 1. U.S. dollar amounts above and elsewhere in this report for the Company are

translated from yen, for convenience only, at the rate of ¥98.23=US$1, the

approximate exchange rate prevailing at March 31, 2009.

2. Equity ratio = (Total net assets – minority interests – share subscription rights)

÷ total assets × 100 (%)

Return on assets = (Operating income + interest and dividend income)

÷ average total assets × 100 (%)

Return on equity = Net income ÷ average (total net assets – minority interests

– share subscription rights) × 100 (%)

Konica Minolta Holdings, Inc. was established in August 2003 through the management integration between Konica

Corporation and Minolta Co., Ltd., creating an essential imaging company. The Konica Minolta Group is pursuing

environmental management-focused growth by utilizing collective Group resources to introduce customer-oriented

products and services through leveraging of unique cutting-edge technologies. The Group has annual sales of nearly ¥950

billion, conducts business operations in approximately 40 nations worldwide and has about 37,000 employees. Based on

an underlying management principle of “New Value Creation” and driven by the corporate mes sage of “the essentials of

imaging”, the Konica Minolta Group aims to provide inspired creativity in the field of imaging by becoming an innovative,

technologically sophisticated, reliable and market-leading global company that is able to enhance corporate value and

respond to the expectations of its stakeholders through corporate creativity.

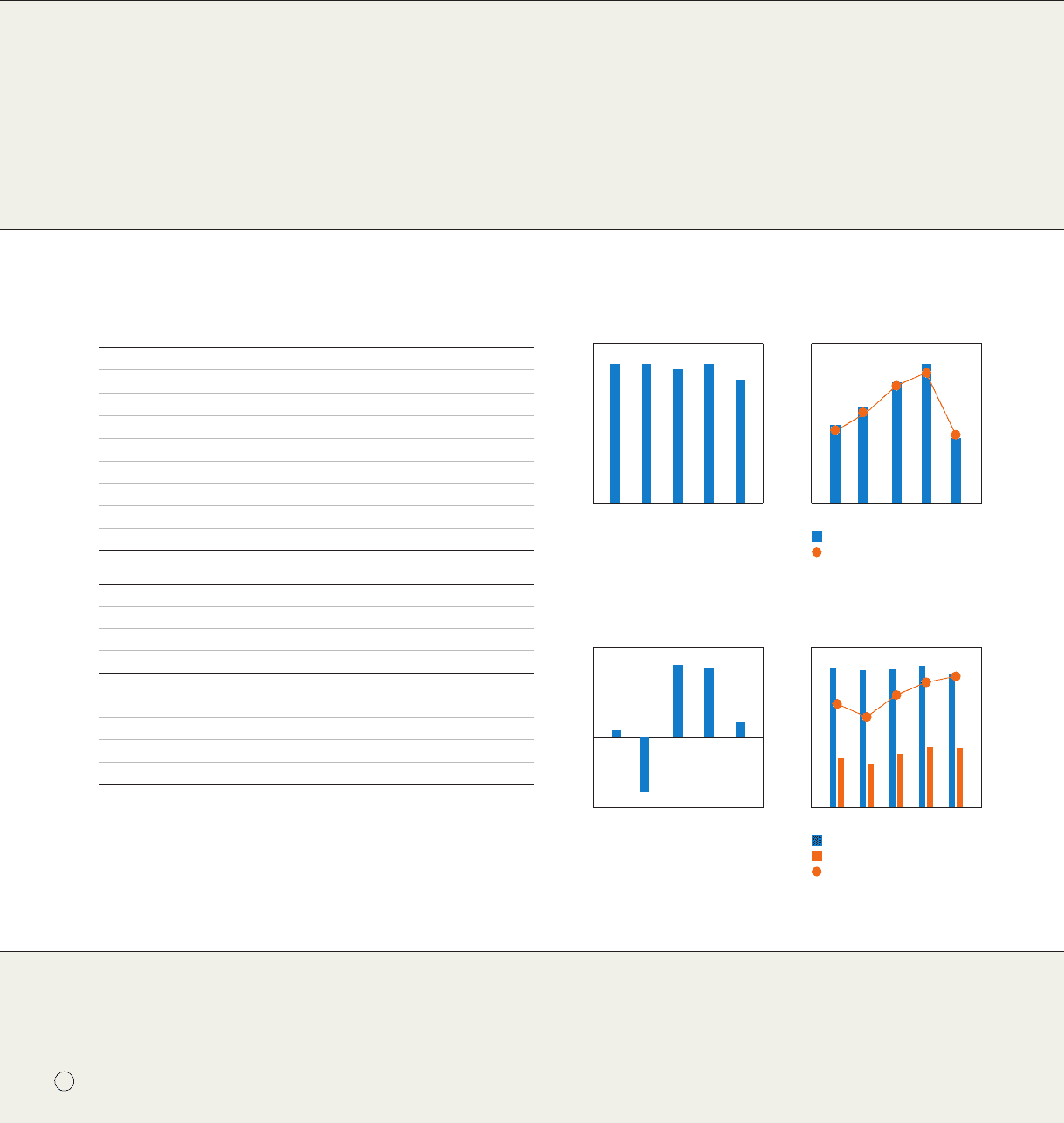

Operating income

Operating income ratio (%)

1,071.6

947.8

* Equity = Total net assets – minority interests

– share subscription rights

Net Sales

Operating Income and

Operating Income Ratio

83.4

119.6

(Billions of Yen) (Billions of Yen)

0

Total assets

Equity*

Equity ratio (%)

Net Income (Loss)

955.5 918.1

367.5

339.7 293.8

413.4

417.2

(Billions of Yen) (Billions of Yen)

1,027.6

1,067.4 1,068.4

67.6

104.0

72.5

7. 5

(54.3)

15.2

68.8

56.3

6.3

7. 8

45.0

43.0

38.6

Total Assets, Equity

and Equity Ratio

5.9

11.2

10.1

970.5

951.1

944.1

31.1

35.6

200720062005 2008 2009

200720062005 2008 2009 200720062005 2008 2009

200720062005 2008 2009

Consolidated Financial Highlights

Fiscal years ended March 31, 2009 and 2008

Disclaimer regarding Forward-Looking Statements

The plans, strategies and statements related to the outlook for future results in

this document are in accordance with assumptions and beliefs deter mined by

management based on currently available information. However, it should be

noted that there is a possibility that actual results could differ significantly due

to such factors as social and economic conditions.