Konica Minolta 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

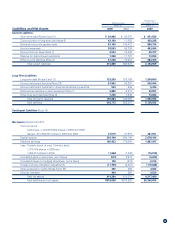

(n) Practical Solution on Unification of Accounting Policies

Applied to Foreign Subsidiaries for Consolidated Financial

Statements

Changes in Accounting Standards

Effective from the year ended March 31, 2009, the Company applied

the “Practical Solution on Unification of Accounting Policies Applied

to Foreign Subsidiaries for Consolidated Financial Statements”

(ASBJ Practical Issues Task Force (PITF) No. 18, issued by the

ASBJ on May 17, 2006). Accordingly, the Company uses financial

statements of the foreign subsidiaries prepared in accordance with

International Financial Reporting Standards or accounting principles

generally accepted in the United States for preparation of the con-

solidated financial statements, except for certain adjustments

required to be made in consolidation to comply with accounting

principles generally accepted in Japan and amended the consoli-

dated financial statements as required.

As a result, the effect of this change was not material to the con-

solidated statement of income. For the year ended March 31, 2009,

lease receivables and investment assets increased ¥13,598 million

($138,430 thousand) in consolidated balance sheet.

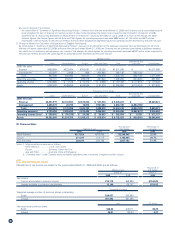

(o) Service Expenses from SG&A Expenses to Cost of Sales

Changes in Accounting Policy

Previously, some consolidated subsidiaries recognized service

expenses (related to digital multifunction devices and other products)

as SG&A expense. Effective from the year ended March 31, 2009,

the Company and its consolidated subsidiaries recognize service

expense as cost of sales, following a change in accounting policy.

As a result of this change, gross profit decreased ¥28,126 million

($286,328 thousand) when compared to the previous method.

(p) Loss on Disposal of Inventories

Changes in Accounting Policy

Previously, some consolidated subsidiaries recognized loss on

disposal of inventories as non-operating expenses.

Effective from the year ended March 31, 2009, the Company and

its consolidated subsidiaries recognize the loss on disposal of

inventories as cost of sales, following the accounting policy review

caused by the introduction of adoption of ASBJ Statement No. 9,

“Accounting Standards for Measurement of Inventories”, issued by

the ASBJ on July 5, 2006.

As a result of this change, gross profit and operating income

decreased ¥2,606 million ($26,530 thousand) when compared to the

previous method.

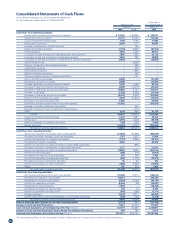

(q) Cash Flows from Operating Activities

“Decrease in provision for bonuses”, “Decrease in accounts receiv-

able-other” and “Decrease in accounts payable-other and accrued

expenses”, which were included within “Other” in the “Cash flows

from operating activities” section of the consolidated statements of

cash flows in the previous fiscal year, are now segmentalized in each

account from the year ended March 31, 2009.

“Increase in allowance for doubtful accounts”, “Increase in

accrued consumption tax payable” and “Reversal of reserve for loss

on impairment of lease assets”, which were segmentalized in the

“Cash flows from operating activities” section of the consolidated

statements of cash flows in the previous fiscal year, are now

included within “Other” from the year ended March 31, 2009.

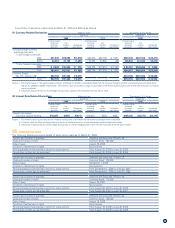

3. U.S. Dollar Amounts

The translation of Japanese yen amounts into U.S. dollars is

included solely for the convenience of the reader, using the pre-

vailing exchange rate at March 31, 2009, which was ¥98.23 to

U.S.$1.00. The translations should not be construed as representa-

tions that the Japanese yen amounts have been, could have been,

or could in the future be, converted into U.S. dollars at this or any

other exchange rate.

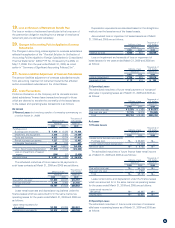

4. Cash and Cash Equivalents

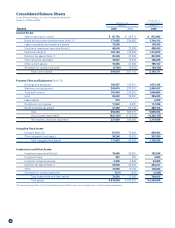

Cash and cash equivalents as of March 31, 2009 and 2008, consist of:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Cash on hand and in banks ¥ 85,753 ¥ 89,218 $ 872,982

Time deposits (over 3 months) (26) (31) (265)

Short-term investments 48,000 33,000 488,649

Cash and cash equivalents ¥133,727 ¥122,187 $1,361,366

5. Investment Securities

As of March 31, 2009

(1) Other Securities with Quoted Market Values

Millions of yen

Original purchase

value

Market value at the

consolidated

balance sheet date

Unrealized gains

(losses)

Securities for which the amounts in the consolidated balance sheet

exceed the original purchase value

(1) Shares ¥ 7,287 ¥ 8,823 ¥ 1,536

(2) Bonds – – –

(3) Other 8 8 0

Subtotal ¥ 7,295 ¥ 8,832 ¥ 1,536

Securities for which the amounts in the consolidated balance sheet

do not exceed the original purchase value

(1) Shares ¥ 8,426 ¥ 6,031 ¥(2,395)

(2) Bonds – – –

(3) Other 8 6 (1)

Subtotal ¥ 8,435 ¥ 6,037 ¥(2,397)

Total ¥15,730 ¥14,869 ¥ (861)

Thousands of U.S. dollars

Total $160,134 $151,369 $(8,765)

(2) Other Securities Sold during the Year Ended March 31, 2009

Millions of yen

Sale value Total profit Total loss

Other securities ¥15 ¥6 ¥0

Thousands of U.S. dollars

Other securities $153 $61 $0

(3) Composition and Amounts on the Consolidated Balance Sheet

of Other Securities without Market Values

Millions of yen Thousands of U.S. dollars

Negotiable deposits ¥48,000 $488,649

Unlisted stocks 648 6,597