Konica Minolta 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

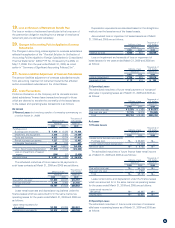

9. Inventories

Inventories as of March 31, 2009 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

Merchandise and finished goods ¥ 87,796 $ 893,780

Work in process 19,003 193,454

Raw materials and supplies 22,360 227,629

Total ¥129,160 $1,314,873

10. Contingent Liabilities

The Companies were contingently liable at March 31, 2009 for loan

and lease guarantees of ¥2,076 million ($21,134 thousand) and at

March 31, 2008 for loan and lease guarantees of ¥3,266 million.

11. Collateral Assets

Assets pledged as collateral for short-term debt of ¥198 million

($2,016 thousand) and long-term debt of ¥146 million ($1,486

thousand) are notes receivable of ¥753 million ($7,666 thousand).

12. Research and Development Costs

Research and development costs included in cost of sales and

selling, general and administrative expenses for the years ended

March 31, 2009 and 2008 are ¥81,904 million ($833,798 thousand)

and ¥81,370 million, respectively.

13. Loss on Impairment of Fixed Assets

The Companies have recognized loss on impairment of ¥1,168 mil-

lion ($11,890 thousand) and ¥5,702 million for the following groups of

assets for the years ended March 31, 2009 and 2008, respectively:

Description Classification Amount

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Manufacturing

facilities of

microlens for

mobile phone

Machinery and

equipment, Tools

and furniture,

Lease assets*

¥ 778 ¥ – $ 7,920

Manufacturing

facilities of

medical and

graphic film etc.

Machinery and

equipment, Tools

and furniture,

Others

103 2,361 1,049

Rental assets Rental business-

use assets

149 91 1,517

Idle assets Land, Buildings

and structures,

Machinery and

equipment, Others

137 328 1,395

Others Goodwill –2,921 –

Total ¥1,168 ¥5,702 $11,890

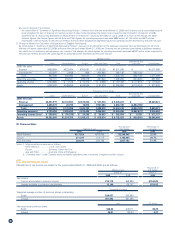

(1) Identifying the cash-generating unit to which an asset belongs:

Each cash-generating unit is identified based on product lines

and geographical areas as a group of assets. For rental assets,

cash-generating units are identified based on rental contracts

and each geographical area. Each idle asset is also identified as

a cash-generating unit.

(2) The Companies have written the assets down to the recoverable

value and recognized an impairment loss due to restructuring of

microlens manufacturing facilities in the Optics business,

worsening of the market environment in the Medical and

Graphic business, etc., and the decline in real estate value, poor

performance and profitability of rental and idle assets.

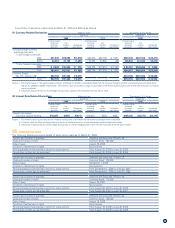

(3) Details of impairment of fixed assets

Amount

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Machinery and equipment ¥648 ¥2,451 $6,597

Rental business-use assets 149 – 1,517

Lease assets* 198 – 2,016

Goodwill –2,921 –

Others 172 330 1,751

(4) Measuring recoverable amount

The recoverable amount of a cash-generating unit is the fair

value less costs to sell. The fair value is supported by an

appraisal report for land and buildings and structures, or a

management estimate for rental business-use assets.

* Lease assets

These lease assets are finance leased assets that do not transfer

ownership, for which the starting date for the lease transaction is prior

to March 31, 2008, and lease payments are recognized as expenses.

14. Discontinued Operations

The amounts included in the statements of income for discon tinued

operations for the years ended March 31, 2009 and 2008 represent:

Amount

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Reversal of excess reserve made

for discontinued operations

in the previous fiscal year ¥1,412 ¥ 8,425 $14,374

Loss on discontinued operations

in the fiscal year under review (480) (7,834) (4,886)

Gain on discontinued operation ¥ 932 ¥ 590 $ 9,488

15. Patent-Related Income

Regarding patent-related income, amounts for patent royalities

related to the Photo Imaging business are recorded.

16. Cost of Sales

The cost of sales includes the cut-down of book values by ¥6,302

million ($64,156 thousand), by a low price method caused by

a decline of profitability and the lower of cost or market value.

17. Gain on Sales of Investments in Affiliated Companies

and Gain on Transfer of Business

The gain on sales of investments in affiliated companies and gain

on transfer of business resulted from the transfer of a domestic

subsidiary and related business assets belonging to the Medical

and Graphic Imaging business to a company outside the Group.

18. Business Structure Improvement Expenses

The business structure improvement expenses consist mainly of

retirement allowances, etc., associated with staff allocation/

optimization in the Business Technologies business, expenses on

business reorganization in the Medical and Graphic Imaging

business, and expenses on the reorganization of manufacturing

facilities in the Optics business.