Konica Minolta 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

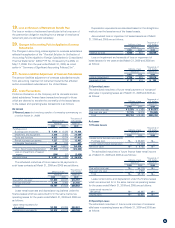

25. Stock Option Plans

The following tables summarize details of stock option plans as of March 31, 2009.

Position and number of grantees Directors and Executive Officers: 26

Class and number of stock Common Stock: 194,500

Date of issue August 23, 2005

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 23, 2005 to June 30, 2006

Period stock options can be exercised From August 23, 2005 to June 30, 2025

Position and number of grantees Directors and Executive Officers: 23

Class and number of stock Common Stock: 105,500

Date of issue September 1, 2006

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From September 1, 2006 to June 30, 2007

Period stock options can be exercised From September 2, 2006 to June 30, 2026

Position and number of grantees Directors and Executive Officers: 24

Class and number of stock Common Stock: 113,000

Date of issue August 22, 2007

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 22, 2007 to June 30, 2008

Period stock options can be exercised From August 23, 2007 to June 30, 2027

Position and number of grantees Directors and Executive Officers: 25

Class and number of stock Common Stock: 128,000

Date of issue August 18, 2008

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 18, 2008 to June 30, 2009

Period stock options can be exercised From August 19, 2008 to June 30, 2028

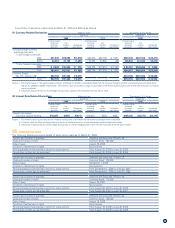

A summary of derivative instruments at March 31, 2009 and 2008 is as follows:

(1) Currency-Related Derivatives Millions of yen Thousands of U.S. dollars

March 31 March 31

2009 2008 2009

Contract value

(notional

principal

amount)

Fair

market

value

Unrealized

gain (loss)

Contract value

(notional

principal

amount)

Fair

market

value

Unrealized

gain (loss)

Contract value

(notional

principal

amount)

Fair

market

value

Unrealized

gain (loss)

Forward foreign currency

exchange contracts:

To sell foreign currencies:

US$ ¥21,978 ¥23,296 ¥(1,318) ¥34,670 ¥32,782 ¥ 1,887 $223,740 $237,158 $(13,417)

EURO 22,253 23,709 (1,455) 30,954 30,983 (28) 226,540 241,362 (14,812)

To buy foreign currencies:

US$ ¥ 9,249 ¥10,025 ¥ 775 ¥15,103 ¥13,912 ¥(1,191) $ 94,157 $102,056 $ 7,890

Total ¥53,481 ¥57,031 ¥(1,998) ¥80,729 ¥77,678 ¥ 667 $544,447 $580,586 $(20,340)

Currency Swaps:

Pay JPY, receive US$ ¥40,736 ¥37,460 ¥ 3,275 –––$414,700 $381,350 $ 33,340

Total ¥40,736 ¥37,460 ¥ 3,275 –––$414,700 $381,350 $ 33,340

Notes: 1. Fair market value of forward foreign currency exchange contracts is calculated based on the forward foreign currency exchange rates prevailing as of

March 31, 2009 and 2008, respectively. Fair market value of currency swaps is provided by the financial institutions with whom the derivative contracts

were concluded.

2. Derivative instruments for which hedge accounting is applied are excluded from the above table.

(2) Interest Rate-Related Derivatives Millions of yen Thousands of U.S. dollars

March 31 March 31

2009 2008 2009

Contract value

(notional

principal

amount)

Fair

market

value

Unrealized

gain (loss)

Contract value

(notional

principal

amount)

Fair

market

value

Unrealized

gain (loss)

Contract value

(notional

principal

amount)

Fair

market

value

Unrealized

gain (loss)

Interest rate swaps:

Pay fixed, receive floating ¥10,387 ¥(371) ¥(371) ¥12,655 ¥(62) ¥(62) $105,742 $(3,777) $(3,777)

Notes: 1. Fair market value is provided by the financial institutions with whom the derivative contracts were concluded.

2. Contract value (notional principal amount) does not indicate the level of risk associated with interest rate swaps.

3. Derivative transactions for which hedge accounting or certain hedging criteria are met are excluded from the above table.