Konica Minolta 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Optics

Sales dropped 4.9%, or ¥8.8 billion, to ¥173.4 billion. We per-

formed well in the first half of the fiscal year by concentrating

on expanding revenues for such strategic products as VA-TAC

films, in which we dominate rivals, and optical pickup lenses for

Blu-ray format. Orders for these offerings plunged from the third

quarter, however, as many digital appliance manufacturers

slashed production.

Operating income fell 59.9%, or ¥18.7 billion, to ¥12.5 billion.

This stemmed from the sales decline and increased deprecia-

tion expenses owing to Japanese tax law reforms. These factors

outweighed more intense efforts to restructure and optimize

our domestic plants and reduce fixed costs.

Medical and Graphic Imaging

Sales decreased 21.9%, or ¥35.2 billion, to ¥125.9 billion. This

was primarily because film sales plunged amid a significant

reduction in worldwide demand.

Operating income was down 60.3%, or ¥4.7 billion, to ¥3.1

billion, as a fall in gross profit from lower unit sales of film

overshadowed extensive cost-cutting efforts.

Sensing

Sales dropped 15.3%, or ¥1.5 billion, to ¥8.4 billion. Operating

income was down 71.4%, or ¥0.9 billion, to ¥0.3 billion. These

results stemmed from a rapid downturn in the global economy,

which forced manufacturers of automotive and electrical

equipment, and other equipment, to constrain capital spending.

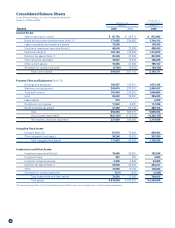

Financial Position

and Liquidity

Analysis of Assets, Liabilities, Net Assets,

and Cash Flows

Our financial position remained fundamentally firm in the fiscal

year under review from the medium- and long-term perspectives.

Despite ongoing reduction efforts over the medium and long

terms, interest-bearing debt stood at ¥230.4 billion at the close

of the year, up ¥4.4 billion. This was because we beefed up our

26

2007 2008 2009

3.4

1. 8 2.1

(Years)

Debt Payback Period

2007 2008 2009

229.4 226.0 230.4

(Billions of Yen)

Interest-Bearing Debt

2007 2008 2009

38.6 43.0 45.0

(%)

Equity Ratio

2007 2008 2009

0.62

0.54 0.56

(Times)

Debt /Equity Ratio

2007 2008 2009

951.1 970.5 918.1

(Billions of Yen)

Total Assets