Konica Minolta 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

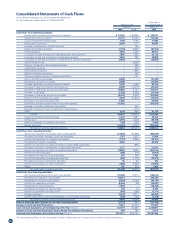

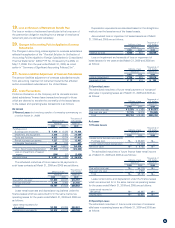

The reconciliation of the Japanese statutory income tax rate to

the effective income tax rate for the years ended March 31, 2009

and 2008 is as follows:

2009 2008

Statutory income tax rate 40.7% 40.7%

Increase (Decrease) in valuation allowance 6.4 (4.9)

Tax credits (5.0) (4.3)

Non-taxable income (0.5) (4.7)

Difference in statutory tax rates of foreign

subsidiaries (0.6) (0.0)

Expenses not deductible for tax purposes 4.5 2.6

Amortization of goodwill 10.9 2.7

Impact of change in the recording standard

of tax effects of retained earnings in

accordance with revision of Corporate

Tax Laws (10.4) –

Ineffective portion of unrealized (gain) loss 5.5 –

Other, net 2.7 (1.8)

Effective income tax rate per consolidated

statements of income 54.3% 30.3%

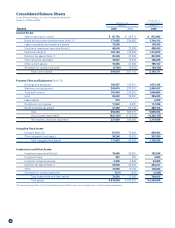

At March 31, 2009 and 2008, significant components of deferred

tax assets and liabilities in the consolidated financial statements are

as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Deferred tax assets:

Net operating tax loss carried

forward ¥ 31,953 ¥ 27,061 $ 325,288

Accrued retirement benefits 29,824 26,973 303,614

Elimination of unrealized

intercompany profits 9,064 20,131 92,273

Reserve for discontinued

operations 6,025 9,565 61,336

Depreciation and amortization 5,661 5,710 57,630

Write-down of assets 5,122 4,151 52,143

Accrued bonuses 4,431 5,768 45,108

Tax effects related to investments 1,717 1,721 17,479

Allowance for doubtful accounts 1,039 1,169 10,577

Accrued enterprise taxes 242 2,059 2,464

Other 10,295 8,657 104,805

Gross deferred tax assets 105,378 112,970 1,072,768

Valuation allowance (33,335) (34,639) (339,357)

Total deferred tax assets 72,043 78,331 733,411

Deferred tax liabilities:

Gains on securities contributed

to employees’ retirement

benefit trust (2,973) (3,042) (30,266)

Retained earnings of overseas

subsidiaries (2,272) (5,455) (23,129)

Special tax-purpose reserve for

condensed booking of fixed

assets (558) (800) (5,681)

Unrealized gains on securities (440) (3,265) (4,479)

Other (1,703) (377) (17,337)

Total deferred tax liabilities (7,948) (12,941) (80,912)

Net deferred tax assets ¥ 64,094 ¥ 65,389 $ 652,489

Deferred tax liabilities related

to revaluation:

Deferred tax liabilities on land

revaluation ¥ (3,889) ¥ (4,010) $ (39,591)

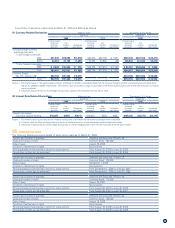

Net deferred tax assets are included in the following items in the

consolidated balance sheets:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Current assets –

deferred tax assets ¥25,326 ¥37,086 $257,823

Fixed assets –

deferred tax assets 39,608 28,604 403,217

Current liabilities –

other current liabilities (734) (248) (7,472)

Long-term liabilities –

other long-term liabilities (105) (53) (1,069)

Net deferred tax assets ¥64,094 ¥65,389 $652,489

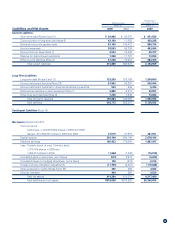

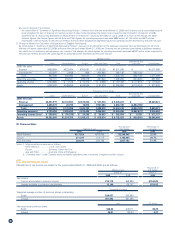

8. Net Assets

The Japanese Corporate Law became effective on May 1, 2006,

replacing the Commercial Code. Under Japanese laws and

regulations, the entire amount paid for new shares is required to

be designated as common stock. However, a company may, by a

resolution of the Board of Directors, designate an amount not

exceeding one half of the price of the new shares as additional

paid-in capital, which is included in capital surplus.

The Japanese Corporate Law provides that an amount equal to

10% of distributions from retained earnings paid by the Company

and its Japanese subsidiaries be appropriated as additional paid-in

capital or legal earnings reserve. Legal earnings reserve is included

in retained earnings in the accompanying consolidated balance

sheets. No further appropriations are required when the total

amount of the additional paid-in capital and the legal earnings

reserve equals 25% of their respective stated capital. The Japanese

Corporate Law also provides that additional paid-in capital and legal

earnings reserve are available for appropriations by the resolution of

the Board of Directors.

Cash dividends and appropriations to the additional paid-in capital

or the legal earnings reserve charged to retained earnings for the

years ended March 31, 2009 and 2008 represent dividends paid out

during those years and the related appropriations to the additional

paid-in capital or the legal earnings reserve.

Retained earnings at March 31, 2009 do not reflect current year-

end dividends in the amount of ¥5,302 million ($53,975 thousand)

approved by the Board of Directors, which will be payable in

June 2009.

The amount available for dividends under the Japanese

Corporate Law is based on the amount recorded in the Company’s

nonconsolidated books of account in accordance with accounting

principles generally accepted in Japan.

On October 30, 2008, the Board of Directors approved cash

dividends to be paid to shareholders of record as of September 30,

2008, totaling ¥5,303 million ($53,986 thousand), at a rate of ¥10.0

per share. On May 14, 2009, the Board of Directors approved cash

dividends to be paid to shareholders of record as of March 31,

2009, totaling ¥5,302 million ($53,975 thousand), at a rate of ¥10.0

per share.