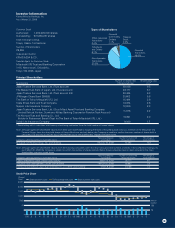

Konica Minolta 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

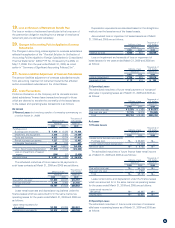

19. Loss on Revision of Retirement Benefit Plan

The loss on revision of retirement benefit plan is the lump sum of

the past service obligation resulting from a change of employees’

retirement plan at a domestic subsidiary.

20. Changes in Accounting Policies Applied to Overseas

Subsidiaries

The Changes in accounting policies applied to overseas subsidiaries

reflects the application of the “Practical Solution for Unification of

Accounting Policies Applied to Foreign Subsidiaries for Consolidated

Financial Statements” (ASBJ PITF No. 18 issued by the ASBJ on

May 17, 2006) from the year ended March 31, 2009, as noted

earlier in “Summary of Significant Accounting Policies 2 (n)”.

21.

Pension Liabilities Adjustment of Overseas Subsidiaries

The pension liabilities adjustment of overseas subsidiaries results

from accounting treatment of retirement benefits that affected

certain consolidated subsidiaries in the United States.

22. Lease Transactions

Proforma information on the Company and its domestic consoli-

dated subsidiaries’ finance lease transactions (except for those

which are deemed to transfer the ownership of the leased assets

to the lessee) and operating lease transactions is as follows:

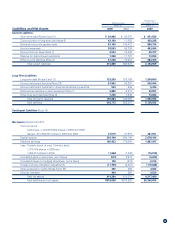

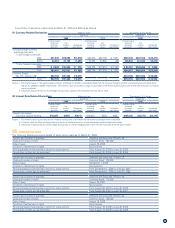

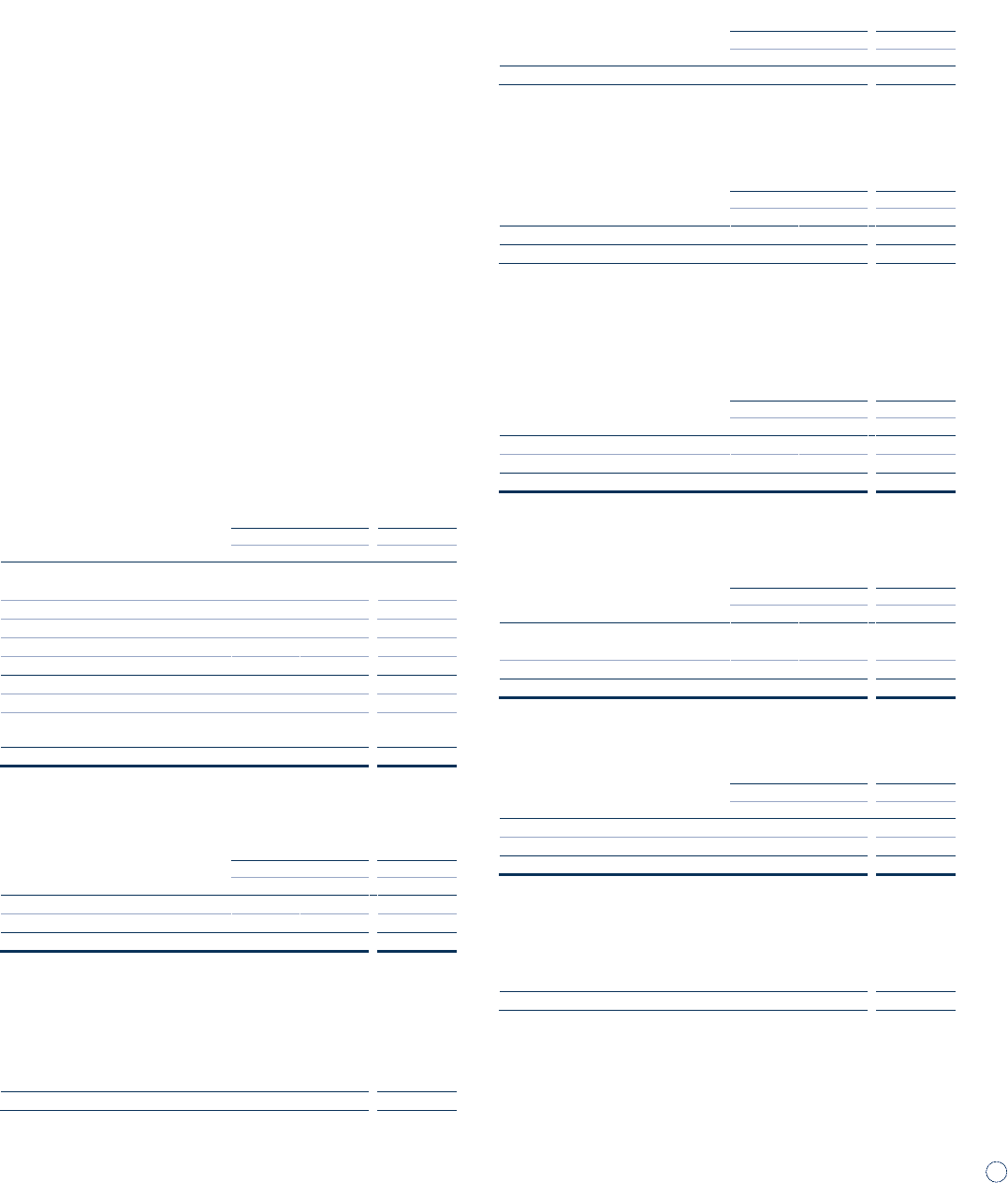

As Lessee

1) Finance Leases (not involving transfer of ownership commencing on

or before March 31, 2008)

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Purchase cost:

Buildings and structures ¥ 7,459 ¥ 8,426 $ 75,934

Machinery and equipment 2,268 2,466 23,089

Tools and furniture 4,622 6,074 47,053

Rental business-use assets 1,227 2,750 12,491

Intangible fixed assets 63 153 641

15,641 19,871 159,228

Less: Accumulated depreciation (11,853) (12,369) (120,666)

Loss on impairment of leased

assets (200) (21) (2,036)

Net book value ¥ 3,587 ¥ 7,480 $ 36,516

The scheduled maturities of future lease rental payments on

such lease contracts at March 31, 2009 and 2008 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Due within one year ¥1,650 ¥3,037 $16,797

Due over one year 2,136 4,464 21,745

Total ¥3,787 ¥7,502 $38,552

Lease rental expenses and depreciation equivalents under the

finance leases which are accounted for in the same manner as

operating leases for the years ended March 31, 2009 and 2008 are

as follows:

Lease rental expenses for

the period ¥2,393 ¥3,395 $24,361

Depreciation equivalents ¥2,373 ¥3,378 $24,158

Depreciation equivalents are calculated based on the straight-line

method over the lease terms of the leased assets.

Accumulated loss on impairment of leased assets as of March

31, 2009 and 2008 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Reserve for loss ¥200 ¥21 $2,036

Loss on impairment and reversals of loss on impairment of

leased assets for the years ended March 31, 2009 and 2008 are

as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Loss on impairment ¥198 ¥23 $2,016

Reversals of loss ¥ 19 ¥16 $ 193

2) Operating Leases

The scheduled maturities of future rental payments of noncancel-

able lease in operating leases as of March 31, 2009 and 2008 are

as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Due within one year ¥ 5,978 ¥ 5,468 $ 60,857

Due over one year 17,175 14,016 174,845

Total ¥23,153 ¥19,485 $235,702

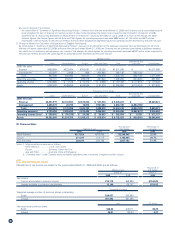

As Lessor

1) Finance Leases

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Leased rental business-use assets:

Purchase cost ¥ – ¥ 22,648 $ –

Less: Accumulated depreciation –(13,523) –

Net book value ¥ – ¥ 9,125 $ –

The scheduled maturities of future finance lease rental income

as of March 31, 2009 and 2008 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2009 2008 2009

Due within one year ¥ – ¥4,179 $ –

Due over one year –4,945 –

Total ¥ – ¥9,125 $ –

Lease rental income and depreciation under the finance leases

which are accounted for in the same manner as operating leases

for the years ended March 31, 2009 and 2008 are as follows:

Lease rental income for

the period ¥ – ¥4,267 $ –

Depreciation ¥ – ¥3,936 $ –

2) Operating Leases

The scheduled maturities of future rental incomes of noncancel-

able lease in operating leases as of March 31, 2009 and 2008 are

as follows: