Konica Minolta 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

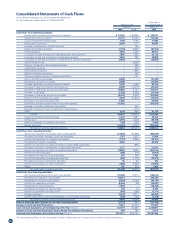

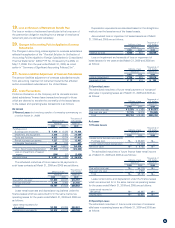

Consolidated Statements of Income

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2009 and 2008

30

Millions of yen

Thousands of

U.S. dollars (Note 3)

March 31 March 31

2009 2008 2009

Net Sales ¥947,843 ¥1,071,568 $9,649,221

Cost of Sales (Notes 12 and 16) 520,206 540,225 5,295,796

Gross profit 427,637 531,343 4,353,426

Selling, General and Administrative Expenses (Note 12) 371,376 411,736 3,780,678

Operating income 56,260 119,606 572,737

Other Income (Expenses):

Interest and dividend income 2,176 2,643 22,152

Interest expenses (4,866) (4,465) (49,537)

Foreign exchange gain (loss), net (7,272) (7,637) (74,030)

Loss on sales and disposals of property, plant and equipment, net (2,866) (3,224) (29,176)

Write-down of investment securities (3,826) (313) (38,949)

Write-down of investment in affiliated companies –(54) –

Loss on disposal of inventories –(7,065) –

Gain on sales of investment securities, net 519 51

Gain on sales of investments in affiliated companies, net (Note 17) 2,803 47 28,535

Loss on impairment of fixed assets (Note 13) (1,168) (5,702) (11,890)

Gain on discontinued operations (Note 14) 932 590 9,488

Equity in net income (losses) of unconsolidated subsidiaries and affiliates (99) 182 (1,008)

Patent-related income (Note 15) 560 8,080 5,701

Gain on transfer of business (Note 17) 3,063 –31,182

Environmental expenses –(1,856) –

Other extraordinary losses of overseas subsidiaries –(1,731) –

Business structure improvement expenses (Note 18) (10,094) –(102,759)

Loss on revision of retirement benefit plan (Note 19) (2,046) –(20,829)

Other, net (336) (120) (3,421)

Total (23,035) (20,609) (234,501)

Income before income taxes and minority interests 33,224 98,996 338,227

Income Taxes (Note 7):

Current 13,183 29,496 134,205

Deferred 4,857 544 49,445

Total 18,040 30,040 183,651

Minority Interests in Net Income of Consolidated Subsidiaries 5 126 51

Net Income ¥ 15,179 ¥ 68,829 $ 154,525

Yen U.S. dollars (Note 3)

March 31 March 31

2009 2008 2009

Per Share Data (Notes 8 and 27):

Net income —Basic ¥28.62 ¥129.71 $0.29

—Diluted 26.91 122.44 0.27

Cash dividends 20 15 0.20

The accompanying Notes to the Consolidated Financial Statements are an integral part of these financial statements.