Konica Minolta 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

As a result of this change, operating income and income before

income taxes and minority interests decreased ¥6,587 million

($67,057 thousand) from the prior year when compared with the

previous method.

(g) Goodwill or Negative Goodwill

Goodwill recognized by the Companies including foreign

subsidiaries is amortized on a straight-line basis over a period not

exceeding 20 years.

(h) Income Taxes

Deferred income taxes are recognized based on temporary

differences between the tax basis of assets and liabilities and

those as reported in the consolidated financial statements.

(i) Research and Development Costs

Research and development costs are expensed as incurred.

(j) Financial Instruments

Derivatives

All derivatives are stated at fair market value, with changes in fair

market value included in net income for the period in which they

arise, except for derivatives that are designated as “hedging

instruments” (see Hedge Accounting below).

Securities

Investments by the Companies in equity securities issued by

unconsolidated subsidiaries and affiliates are accounted for using

the equity method; however, investments in certain unconsoli dated

subsidiaries and affiliates are stated at cost because the effect of

application of the equity method would be immaterial.

Other securities for which market quotations are available are

stated at fair market value. Net unrealized gains or losses on these

securities are reported, net of tax, as a separate component of

net assets.

Other securities for which market quotations are unavailable are

stated at cost, except in cases where the fair market value of equity

securities issued by unconsolidated subsidiaries and affiliates or

other securities has declined significantly and such impairment of

value is deemed other than temporary. In these instances, securi-

ties are written down to the fair market value and the resulting

losses are charged to income during the period.

Hedge Accounting

Gains or losses arising from changes in fair market value of

derivatives designated as “hedging instruments” are deferred as

an asset or a liability and charged or credited to income in the

same period that the gains and losses on the hedged items or

transactions are recognized.

Derivatives designated as hedging instruments by the

Companies are principally interest rate swaps, and forward foreign

currency exchange contracts. The related hedged items are trade

accounts receivable and payable, long-term bank loans and debt

securities issued by the Companies.

The Companies have a policy to utilize the above hedging instru-

ments in order to reduce the Companies’ exposure to the risk of

interest rate and exchange rate fluctuations. As such, the

Companies’ purchases of the hedging instruments are limited to,

at maximum, the amounts of the hedged items.

The Companies evaluate the effectiveness of their hedging

activities by reference to the accumulated gains or losses on the

hedging instruments and the related hedged items from the

commence ment of the hedges.

(k) Leases (as a lessee)

Changes in Accounting Standards

Previously, lease payments under finance leases that do not trans-

fer ownership of the leased property to the lessee were recognized

as an expense. Effective from the year ended March 31, 2009, the

Company and its domestic consolidated subsidiaries adopted ASBJ

Statement No. 13, “Accounting Standard for Lease Transaction”,

and ASBJ Guideline No. 16, “Guidance on Accounting Standard for

Lease Transaction”, originally issued by the Business Accounting

Deliberation Council on June 17, 1993 and the Japanese Institute of

Certified Public Accountants on January 18, 1994, respectively, and

both revised by the ASBJ on March 30, 2007. Consequently, lease

assets are recognized as a normal sales transaction. This adoption

had no impact on the consolidated statements of income.

Upon adoption, lease payments under finance leases, previously

accounted for in the “Cash flows from operating activities” section

of the consolidated statement of cash flows, are now accounted

for in the “Cash flows from financing activities” section. The effect

of this change was not material to the consolidated statement of

cash flows.

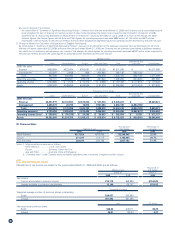

(l) Retirement Benefit Plans

Retirement Benefits for Employees

The Company, domestic consolidated subsidiaries and certain over-

seas consolidated subsidiaries have obligations to make defined

benefit retirement payments to their employees and, therefore, pro-

vide accrued retirement benefits based on the estimated amount of

projected benefit obligations and the fair value of plan assets.

For the Company and its domestic consolidated subsidiaries,

unrecognized prior service cost is amortized by the straight-line

method over a 10-year period, which is shorter than the average

remaining years of service of the eligible employees. Unrecognized

net actuarial gain or loss is primarily amortized from the following

year by the straight-line method over a 10-year period, which is shorter

than the average remaining years of service of the eligible employees.

Accrued Retirement Benefits for Directors and Statutory Auditors

Domestic consolidated subsidiaries record a reserve for retirement

benefits for directors and statutory auditors based on the amount

payable accumulated at the end of the period based on the

internal regulations.

(m) Per Share Data

Net income per share of common stock has been computed based

on the weighted-average number of shares outstanding during

the year.

Cash dividends per share shown for each year in the accompany-

ing consolidated statements are dividends declared as applicable to

the respective year.