Konica Minolta 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

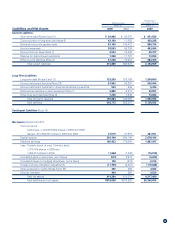

cash position to overcome financial market instability. Our

debt-to-equity ratio was 0.56 times, up 0.02 point. Shareholders’

equity was down ¥3.8 billion, at ¥413.4 billion, although the

equity ratio improved 2.0 percentage points, to 45.0%, as total

assets dropped significantly.

Despite sluggish operating results, our debt repayment indi-

ces weakened only slightly. The interest coverage ratio was 23.4

times, down 4.3 points. The debt payback period (operating cash

flows to interest-bearing debt) was 2.1 years, up from 1.8 years.

Our long-term debt ratings were unchanged.

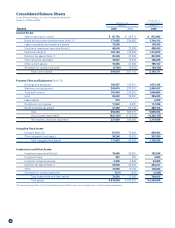

As of March 31, 2009

Rating & Investment Japan Credit Rating

Information, Inc. Agency, Ltd.

Rating A– A

Outlook Positive Stable

Assets, Liabilities, and Net Assets

At year-end, total assets were ¥918.1 billion, down ¥52.5 billion.

This was despite a ¥15.0 billion increase in short-term invest-

ment securities, and reflected a ¥63.0 billion decline in trade

notes and accounts receivable because of lower sales, an ¥18.1

billion drop in net property, plant and equipment owing to capital

spending constraints, and a ¥10.6 billion fall in investment

securities, reflecting an equity market downturn. Inventories

were down ¥3.8 billion, to ¥129.2 billion, as we scaled back

production in response to lower sales.

Total liabilities decreased ¥48.5 billion, to ¥503.8 billion. This

was due largely to a decrease in trade notes and accounts pay-

able because of production adjustments in line with lower sales.

Long-term loans payable soared, as we increased cash to cover

bond redemptions and loan repayments.

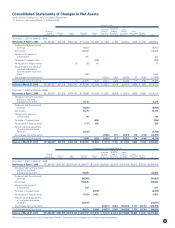

Net assets were ¥414.3 billion at year-end, down ¥4.0 billion.

This was because of a decrease in foreign currency translation

adjustments and a decline in the valuation difference on

available-for-sale securities owing to a stock market slump,

which offset an increase in retained earnings from the

contribution of ¥15.2 billion in net income.

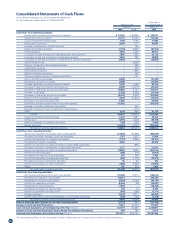

Cash Flows

Net cash provided by operating activities was ¥107.6 billion,

down ¥15.5 billion from a year earlier. The principal cash flow

contributors were ¥33.2 billion in income before income taxes

and minority interests, ¥70.2 billion in depreciation and

amortization, and a ¥36.7 billion increase in working capital from

trade notes and accounts receivable, inventories, and trade

notes and accounts payable, offset partly by ¥34.7 billion in

income taxes paid. The decline in net cash provided by operat-

ing activities reflected a ¥65.8 billion drop in income before

income taxes and minority interests, which overshadowed

a ¥34.0 billion improvement because of enhanced working

capital efficiency.

Net cash used in investing activities was ¥90.2 billion, up

¥13.4 billion. One factor was ¥28.0 billion spent in acquiring

shares in DOIC and other subsidiaries to boost sales of

Business Technologies operations in the United States. Also

important was ¥61.6 billion in expenditure to buy tangible fixed

assets, mainly to increase the Optics business’s production

capacity in glass hard disk substrates and TAC films. The rise in

net cash used in investing activities was principally because we

boosted acquisitions of shares in DOIC and other subsidiaries

by ¥21.2 billion, against which we generated ¥7.8 billion in

proceeds from the Medical and Graphic Imaging business’s

sales of investments in consolidated subsidiary and transfer

of business.

Free cash flow was thus ¥17.4 billion, down ¥28.8 billion.

Net cash provided by financing activities was ¥5.0 billion,

reflecting a ¥16.9 billion rise in interest-bearing debt and the use

of ¥9.3 billion to pay cash dividends. In the previous fiscal year,

we used net cash of ¥10.5 billion in financing activities.

At the end of the term, cash and cash equivalents were

¥133.7 billion, up ¥11.5 billion.

Regarding the anticipated business environment for the fiscal

year ending March 31, 2010, domestic and overseas economic

prospects for the year ahead are admittedly unclear, but

management expects that the operating climate will remain

very adverse. Despite recovery signs in some businesses,

companies will likely continue to constrain investments and cut

costs for the foreseeable future. It should therefore take consid-

erable time for demand to fully recover, as we focus heavily on

office MFPs and other business-to-business offerings. We will

need to closely monitor the possible impacts of trends in the

U.S. dollar, the euro, and other currencies on our operations

and performance.

27