Konica Minolta 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 6

Q. Please describe the expected effects of the integration.

A. In all integrated fields, we are promoting greater efficiency by

revamping our business structures, as well as consolidating and

streamlining organizations. We are also reducing procurement

cost through improved purchasing power, driving sales by

increased marketing efficiency, and in particular reducing

employee numbers by 4,000 across the Group. These measures

will produce annual cost savings of ¥50 billion in fiscal 2005. In the

image information business, the largest business for both Konica

and Minolta, Konica has great strength in the development and

marketing of high-speed multifunctional peripherals (MFPs), while

Minolta has strong developing and marketing ability in medium- to

low-speed MFPs and particularly color MFPs and laser printers

(LBPs), where it maintains a large share of the market. As an

integrated force, the new company will possess an extremely

formidable technical and marketing advantage over many of its

rivals. In addition, the Company is deriving tremendous synergy by

utilizing the advantage of the polymerization toner, another core

business. The combined strengths will result in further dramatic

improvements in competitiveness, while at the same time greatly

increase the impact the Company has on the marketplace, and

increase sales. In addition, referring to the optical technology field

that is another strength of both companies, combining Konica’s

plastic lens technology with Minolta’s glass mold technology, we

will expand our business and further solidify our hold on the top

spots in the optics business. In our microcamera unit business,

where we expect rapid expansion, we aim for sizable business

growth, including building a structure capable of striving for the

top share of the market. In our camera and consumer imaging

business, we aim for increased earning power and greater sales

by building a solid marketing organization for all of our camera and

photosensitive paper product lines.

We will increase sales and earnings through benefits derived

from the integrated product lineups and the strengthened

worldwide marketing network.

Q. What are the workings of the integration?

A. Konica Corporation migrated to a holding company structure

in April 2003, and Konica Corporation and Minolta Co., Ltd.

concluded management integration in an exchange of shares in

August 2003, with one share of Minolta stock being valued at

0.621 share of Konica stock. With completion of the stock swap,

the name of the integrated company was changed to Konica

Minolta Holdings, Inc. Given that the post-integration management

structure consists of spinning off business operations into

independent companies under the holding company, we opted for

the exchange of shares scheme because it would simplify the

processing involved. While Konica Minolta Holdings, Inc. is built on

the foundation of equality between the two companies, this is in

fact the creation and birth of a new corporate group.

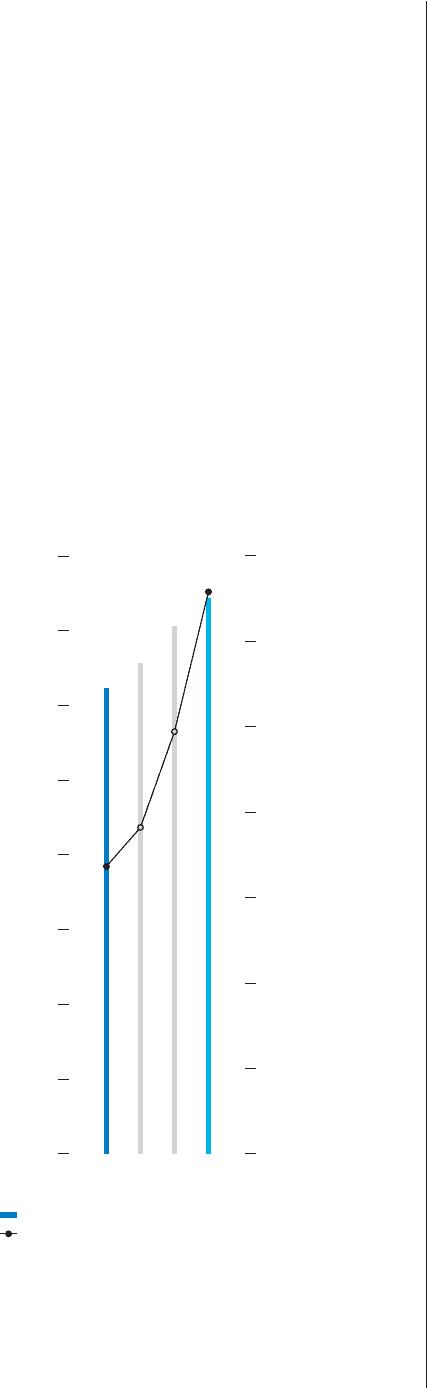

’03

1,087

’04 ’05 ’06

160

Net Sales (Right Scale)

Operating Income (Left Scale)

Net Sales and Operating Income Targets

0

20

40

60

80

100

120

140

0

200

Note: Forecasts are as of January 15, 2003, the date the "Letter of Intent for

the Management Integration" was announced.

400

600

800

1,000

1,200

1,400

150

1,300

77.3

(Billions of yen)