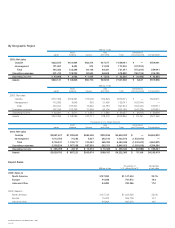

Konica Minolta 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 34

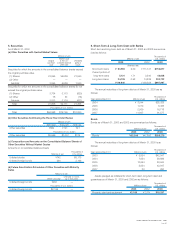

Securities

Securities held by the Company and its subsidiaries are classified into two

categories:

Investments of the Company in equity securities issued by unconsoli-

dated subsidiaries and affiliates are accounted for by the equity method.

Exceptionally, investments in certain unconsolidated subsidiaries and affiliates

are stated at cost because the effect of application of the equity method

would be immaterial.

Other securities for which market quotations are available are stated at

fair value.

Net unrealized gains or losses on these securities are reported as a sep-

arate item in shareholders’ equity at a net-of-tax amount.

Other securities for which market quotations are unavailable are stated at

cost, except as stated in the following paragraph.

However, in cases where the fair value of equity securities issued by

unconsolidated subsidiaries and affiliates, or other securities has declined

significantly and such impairment of the value is not deemed temporary,

those securities are written down to the fair value and the resulting losses are

included in net profit or loss for the period.

Hedge Accounting

Gains or losses arising from changes in fair value of the derivatives desig-

nated as “hedging instruments” are deferred as an asset or liability and

included in net profit or loss in the same period during which the gains and

losses on the hedged items or transactions are recognized.

The derivatives designated as hedging instruments by the Company are

principally interest swaps, commodity swaps, and forward exchange con-

tracts. The related hedged items are trade accounts receivable and payable,

raw materials, long-term bank loans, and debt securities issued by the

Company.

The Company has a policy to utilize the above hedging instruments in

order to reduce the Company’s exposure to the risk of interest rate, com-

modity price, and exchange rate. Thus, the Company’s purchases of the

hedging instruments are limited to, at maximum, the amounts of the hedged

items.

The Company evaluates effectiveness of its hedging activities by refer-

ence to the accumulated gains or losses on the hedging instruments and the

related hedged items from the commencement of the hedges.

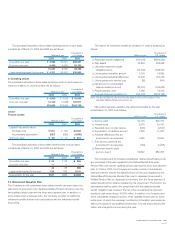

(j) Accrued Retirement Benefits

Pension and severance costs for employees are accrued based on the esti-

mates of projected benefit obligations and the plan assets at the end of

current fiscal year. The actuarial difference is amortized mainly over a period

of 10 years, which is within the average remaining service period, using

straight-line method from the next year in which they arise.

The prior service cost is amortized mainly over a 10-year period, which is

within the average remaining service period, using straight-line method from

the time when the difference was generated.

Pursuant to the Defined Benefit Enterprise Pension Plan Law, the

Company and several consolidated subsidiaries obtained approval from the

Minister of Health, Labor and Welfare for the exemption from the payment for

future benefits of the Entrusted Government’s Portion. The Company and

several consolidated subsidiaries applied accounting for Liquidation of the

Entrusted Government’s Portion at the date of approval resulting in relin-

quishment of the entrusted portion of the retirement benefit obligation of

welfare pension funds and the related pension fund assets, which is allowed

as an alternative accounting method in accordance with article 47-2 of

Accounting Committee Report No.13 “Practical Guidance for Accounting for

Retirement Benefits (Interim Report)” issued by the Japanese Institute of

Certified Public Accountants. The effect to the statements of income result-

ing from the accounting treatment applied is described in Note 12.

Retirement Benefits Plan.

On April 30, 2003, the Company, upon enactment of Defined

Contribution Pension Plan Law, transferred a portion of defined benefit

pension plan to a defined contribution pension plan. Pursuant to Financial

Accounting Standards Implementation Guidance No.1 “Accounting for

Transfers between Retirement Benefit Plans” issued by Accounting Standard

Board of Japan, and “Report of Practical Issues No.2 Practical Treatment of

Accounting for Transfers between Retirement Benefit Plans” issued by the

Accounting Standards Board of Japan, the effect resulting from the account-

ing treatment applied to the statements of income are described in Note 12.

Retirement Benefits Plan.

(k) Per Share Data

Net income per share of common stock has been computed based on the

weighted average number of shares outstanding during the year.

Cash dividends per share shown for each year in the accompanying

consolidated statements are dividends declared as applicable to the respec-

tive years.

3. U.S. Dollar Amounts

Amounts in U.S. dollars are included solely for the convenience of readers

outside Japan. The rate of ¥120.20=US$1, the rate of exchange on March

31, 2003, has been used in translation. The inclusion of such amounts is not

intended to imply that Japanese yen have been or could be readily con-

verted, realized or settled in U.S. dollars at this rate or any other rate.

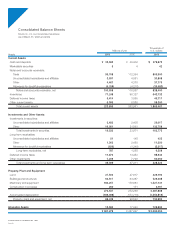

4. Cash and Cash Equivalents

Cash and cash equivalents consisted of:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Cash and bank deposits ¥51,876 ¥47,359 $431,581

Money management funds 0300 0

Cash and cash equivalents ¥51,876 ¥47,659 $431,581