Konica Minolta 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareho ld ers

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 2

Between 1998 and 1999, under the influence of the stagnant silver-halide photographic

market, Konica Corporation lost momentum in its photographic film business, which had

been its prime source of earnings. This situation, combined with increasingly fierce

competition in this sector, served to temporarily stall revenue. To make matters worse, an

increase in interest-bearing debt at the time also had a negative impact on Konica’s balance

sheet.

Given these circumstances, management decided that a thorough reorganization of the

business structure was required. Based on that decision, we began by focusing our business

operations, eliminating those sectors that were not profitable. At the same time, we shifted to

a management structure concentrating on free cash flows, with the aim of improving our

financial affairs. Using these accomplishments as a springboard, in 2000 we formulated the

SAN Plan, a medium-term management plan. We also progressed with digital networking

across all of our business domains, and shifted toward growth sectors. Through these

actions, we made significant improvements to our earnings potential. We are also diligently

advancing improvements to management efficiency. Responsive and timely management

and business portfolio management yielded significant results in fiscal 2002, ended March

31, 2003, with Konica recording its highest levels ever in operating income, recurring income,

and net income.

In 1999, Minolta Co., Ltd. formulated NEXT ’03, its new medium-term management plan,

that essentially outlined an aggressive strategy for growth and expansion over the next five

years. Some factors, however, prevented the Company from performing as planned. Chief

among these were sluggish market growth, increasingly fierce competition, and exchange

rate fluctuations beyond expectations. At the same time, such adjustments as book

reductions in share crossholdings, in accordance with changes in accounting standards to

comply with global standards, were also adopted during this period, with the result that

Minolta recorded a significant net loss in the first half of fiscal 2001.

Under these conditions, management reexamined the state of the medium-term

management plan, while working to change the management mind-set within the group. We

implemented strategies that focused even further on the selection and concentration of a

specific genre and lineup of products and those regions where the Company could attain the

number one position in the market. Management also focused on capital efficiency and cash

flows, rather than profit and loss. In particular, we have revamped our companywide

structure, reducing the number of employees, lowering procurement costs, and eliminating

excess inventory. We have also moved swiftly to reduce our growing interest-bearing debt.

Thanks to the contributions made by these various structural reforms, together with real

contributions to our performance by those product lines where we have been advancing:

digitization, colorization, and the specific genre strategy, we recorded our highest-ever

results in net sales, operating income, and recurring income for fiscal 2002, while

successfully reducing interest-bearing debt from ¥250 billion as of the end of fiscal 2001, to

¥171 billion.

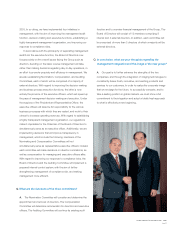

Fumio Iwai, President & CEO (Left)

Yoshikatsu Ota, Vice President (Right)