Konica Minolta 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 27

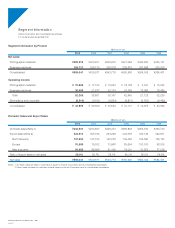

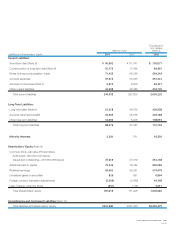

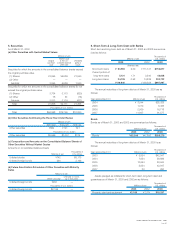

Assets, Liabilities, and Equity

Total assets as of March 31, 2003 totaled ¥516.0 billion, a decline of

¥11.4 billion compared with the previous fiscal year-end. In current

assets, trade notes and accounts receivable declined ¥8.0 billion

and inventory fell ¥3.5 billion. The balance of cash and other current

assets however increased ¥13.7 billion, for an aggregate rise in total

current assets of ¥2.2 billion.

For the fiscal year under review, capital expenditures of ¥21.6

billion fell below depreciation expense of ¥28.5 billion. As a result,

the balance of property, plant and equipment, net, fell ¥8.0 billion.

Investments and other assets declined by ¥5.6 billion for an aggre-

gate fall in fixed assets of ¥13.6 billion. As a result, the balance of

total assets as of the fiscal year-end decreased ¥11.4 billion.

On the liabilities side, current liabilities declined ¥23.8 billion.

Major components were an increase of ¥5.6 billion in reserve for

structural reforms relating to the consumer imaging business and

declines in interest-bearing debt and other current liabilities of ¥28.8

billion and ¥0.6 billion, respectively. Long-term liabilities rose ¥1.1 bil-

lion resulting in an aggregate decline in total liabilities of ¥23.7 billion.

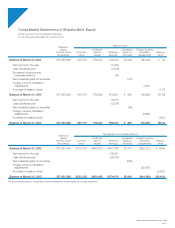

Turning to shareholders’ equity, while consolidated retained

earnings increased by ¥12.8 billion, foreign currency translation and

other losses increased by ¥2.7 billion. As a result, total shareholders’

equity increased ¥9.8 billion compared with the previous fiscal year-

end.

Reducing total assets and increasing shareholders’ equity in this

manner resulted in an increase of 2.6 percentage points in the share-

holders’ equity ratio over the previous fiscal year to 35.1%.

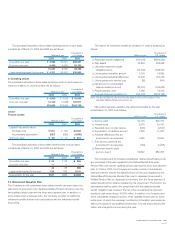

Capital Expenditures and Research and Development Expenditures

Konica invested ¥6.5 billion in capital expenditures primarily in the

upgrade of production facilities for medical-use dry film and inkjet

paper in the photographic materials business. In business machines,

cameras, and optical products, the Company undertook

expenditures totaling ¥6.7 billion in an effort to bolster production

facilities for optical disk non-spherical plastic lenses, copiers, and

polymerization toners.

Other capital expenditures amounted to ¥8.4 billion and were

used for the acquisition of buildings owned by the Company and the

development of information and management systems in line with the

companies move toward spin off and a holding company structure.

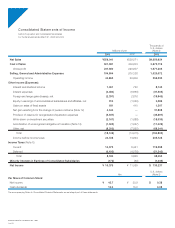

R&D expenses for the fiscal year under review increased ¥1.4

billion to ¥30.3 billion. An amount ¥13.8 billion was allocated to the

photographic materials business, ¥11.6 billion to business machines,

cameras, and optical products, and ¥4.9 billion to the development

of the Group’s platform technologies and in particular state-of-the-art

technologies and digital networking.

Outlook

The market trend toward adopting digital networks continues to

advance at a rapid pace. At the same time, however, the world’s

major economies continue to show few signs of recovery. Under

these conditions, Konica has decided to adopt a holding company

structure with the aim of promoting speedy and efficient business

portfolio management. In establishing an entirely new entity under a

strengthened format, Konica is working to strengthen its business

platform and to enhance the corporate value of the Group for the

benefit of its shareholders.

(Billions of Yen)

0

12

24

36

48

’99 ’00 ’01 ’02 ’03

Capital Expenditures

(Billions of Yen)

0

10

20

30

40

’99 ’00 ’01 ’02 ’03

Depreciation Expenses

(Billions of Yen)

0

8

16

24

32

’99 ’00 ’01 ’02 ’03

R&D Expenditures