Konica Minolta 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 5

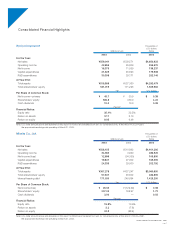

Business Integration Time Line

Apr. 2000

Konica and Minolta—basic agreement on business alliance focusing on

product development in the field of image information and the start of a

consumables-related joint-venture business.

Dec. 2000

Konica and Minolta’s joint venture for polymerized toner, Konica Minolta

Supplies Manufacturing Co., Ltd., starts operations.

Feb. 2002

Feasibility study for the management integration of both companies

commenced.

Sep. 2002

Konica and Minolta agree to increase capital of joint-venture Konica

Minolta Supplies Manufacturing Co., Ltd., each company to contribute

¥1.3 billion.

Jan. 2003

Management integration of Konica Corporation and Minolta Co., Ltd.

announced.

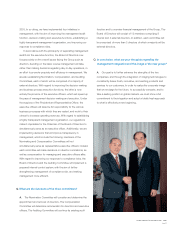

Q. What were the factors that brought this integration to

fruition?

A. Both our companies had a strong awareness of impending

crisis vis-a`-vis our business environment. And in April 2000, we

agreed to an operating partnership in the image information field

for the codevelopment of mutually complementary products. As

part of this alliance, we established a joint-venture company,

Konica Minolta Supplies Manufacturing Co., Ltd. in December

2000 for the purpose of mass-producing the next-generation

polymerization toner. This partnership in business operations has

produced significant results, strengthening our mutual sense of

trust and reliance. By means of this partnership, we have

generated synergy, primarily through a mutual relationship of trust

and collaboration. Building on these accomplishments, we came

to the mutual conclusion that combining and reinforcing our

strengths would enable us to secure an unquestioned place

among the top corporate groups in the industry. We also shared

the belief that integration would make it possible for us to make

our businesses stronger, and push us into the top ranks of

businesses in terms of revenues.

Q. What are your reasons for choosing this time to integrate?

A. In order to survive in the competitive global arena, we need a

system capable of operating more speedily and focusing on

competition, in a business structure that is closer to our customers

than ever before. Furthermore, in order to respond to rapidly

changing business environments, a more unique business

structure is required. That is to say, it is imperative that we build a

system that separates management and operating executive

functions Group-wide, wherein management will pursue strategies

that maximize profits and minimize Group-wide risks, and the

operating executive will maximize company competitiveness in the

marketplace. Accordingly, Konica adopted a holding company

format and spun off business operations in April 2003. Minolta had

in fact introduced an internal company system from April 2002. To

further accelerate management decision-making and processes,

and improve competitiveness, however, the companies decided

that it would be in their best interests to integrate management

promptly after Konica had spun off its business operations into

independent companies and formed a holding company.

Q. What are the objectives of this integration?

A. In addition to implementing portfolio management centered

on the image information business, the Group’s largest business

field, we will work to maximize corporate value and build a

structure capable of dramatically pursuing business

competitiveness. Another central aspect of the integration is

combining our respective strengths in optical technologies to

make our optics business more solid. Based on the simple sum of

the two companies’ sales, the new entity would exceed net sales

of ¥1 trillion for the fiscal year ended March 31, 2003. The new

corporate group will aim for net sales of ¥1.3 trillion, and operating

income of ¥150 billion in fiscal 2005.