Konica Minolta 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

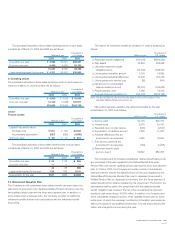

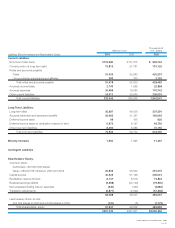

6. Short-Term & Long-Term Debt with Banks

Short-term and long-term debt as of March 31, 2003 and 2002 are summa-

rized as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

(Interest rate)

Short-term loans ¥ 90,592 2.09 ¥111,741 $753,677

Current portion of

long-term loans 5,121 1.71 2,540 42,608

Long-term loans 24,126 0.92 14,226 200,722

¥119,840 ¥128,508 $997,997

The annual maturities of long-term debt as of March 31, 2003 are as

follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2004 ¥ 3,044 $25,329

2005 1,019 8,483

2006 2,009 16,718

2007 11,007 91,577

Bonds

Bonds as of March 31, 2003 and 2002 are summarized as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Bonds ¥32,246 ¥47,600 $268,270

The annual maturities of long-term debt as of March 31, 2003 is as

follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2003 ¥ 5,054 $42,047

2004 7,054 58,686

2005 10,054 83,644

2006 5,054 42,047

2007 30 250

Assets pledged as collateral for short-term debt, long-term debt and

guarantees as of March 31, 2003 and 2002 are as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

Property, plant and equipment ¥2,199 ¥2,374 $18,297

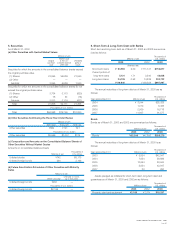

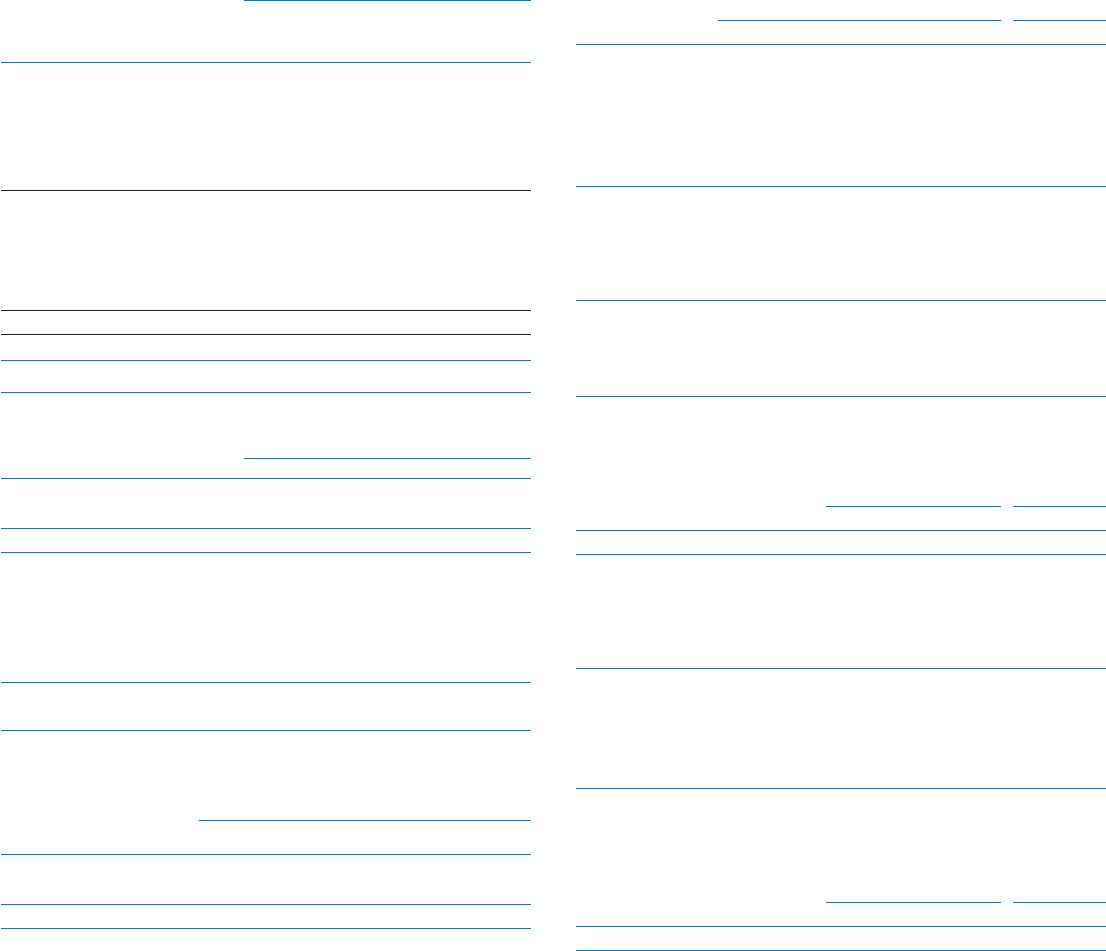

5. Securities

As of March 31, 2003

(a) Other Securities with Quoted Market Values

Millions of yen

Market value

Original at the con- Unrealized

purchase solidated balance gains or

value sheet date losses

Securities for which the amounts in the consolidated balance sheets exceed

the original purchase value

(1) Shares ¥3,995 ¥5,936 ¥1,940

(2) Other — — —

Subtotal 3,995 5,936 1,940

Securities for which the amounts in the consolidated balance sheets do not

exceed the original purchase value

(1) Shares 3,734 3,113 (620)

(2) Other 78 61 (16)

Subtotal 3,812 3,174 (637)

Tota l ¥7,808 ¥9,111 ¥1,303

Thousands of U.S. dollars

Total $64,958 $75,799 $10,840

(b) Other Securities Sold During the Fiscal Year Under Review

Millions of yen

Sale value Total profit Total loss

Other securities ¥669 ¥121 ¥21

Thousands of U.S. dollars

Other securities $5,566 $1,007 $175

(c) Composition and Amounts on the Consolidated Balance Sheets of

Other Securities Without Market Quotes

Amounts on consolidated balance sheets

Thousands of

Millions of yen U.S. dollars

Unlisted stocks ¥742 $6,173

Unlisted foreign bonds 264 2,196

(d) Future Amortization Schedules of Other Securities with Maturity

Dates

Millions of yen

One year or more,

Within one year up to five years

Unlisted foreign bonds ¥264 —

Thousands of U.S. dollars

Unlisted foreign bonds $2,196 —

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 35