Konica Minolta 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KONICA M INOLTA HOLDINGS, INC. 2 0 0 3

Pag e 24

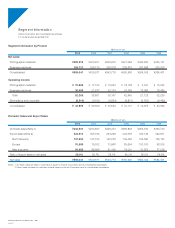

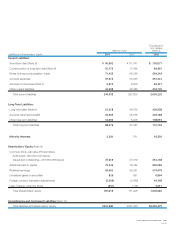

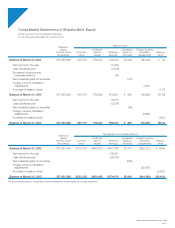

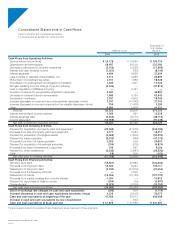

Consolidated Financ ial Review

Scope of Consolidated Financial Results

The Konica Group comprises Konica Corporation, 75 consolidated

subsidiaries, 18 unconsolidated subsidiaries, and 9 affiliated

companies.

The businesses operated by Konica Corporation and its sub-

sidiaries comprise the following two business segments and are dif-

ferentiated on a product basis. The Photographic Materials segment

deals primarily in the production and marketing of color film, paper,

minilab equipment, film and processing equipment for identification

photos, x-rays, and printing, as well as TAC film for LCD polarization

plates and inkjet printing products. The Business Machines segment

deals primarily in the production and marketing of cameras, digital

cameras, copiers, facsimiles machines, printers, and other business

machines, as well as polymerization toner, OPC drums, and optical

pickup lenses.

Consolidated Business Results

Sales

In fiscal 2002, the fiscal year ended March 31, 2003, the downward

trend in the world’s largest economies, the U.S. and Europe, grew

stronger. Concerns about the conflict in Iraq combined with this

trend to prolong the global recession, further delaying the possibility

of economic recovery. The Japanese economy remained sluggish,

owing to uncertainty over the future. Capital investment continued to

contract, while consumer spending remained lackluster owing in

large part to deepening anxieties over the employment situation.

Against this backdrop, Konica experienced a strong performance in

its strategic growth businesses and was boosted by the yen’s depre-

ciation against the U.S. dollar and the euro. In the fiscal year ended

March 31, 2003, consolidated net sales rose 3.6% year on year,

from ¥539.6 billion, to ¥559.0 billion.

By business segment, in the Photographic Materials and Photo-

related Industrial Equipment Companies sales of color film and

printing paper fell due to the increasing trend toward market digitiza-

tion. At the same time, in the Business Machines, Cameras, and

Optical Products, sales of medium- and high-speed copiers in the

Office Document Company and optical pickup lenses in the Optical

Products Company were strong.

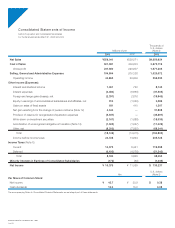

Cost of Sales, and Selling, General and Administrative

Expenses

The cost of sales during the fiscal year under review increased ¥11.7

billion, compared with the previous period, to ¥321.4 billion. While

the Company incurred increased overseas procurement costs due

to the yen’s depreciation against major currencies, efforts to reduce

production costs and increased sales volume enabled Konica to

hold the cost of sales to essentially the same level as the previous

fiscal year. As a result of these factors, gross profit increased 3.4%

year on year to ¥237.7 billion.

Selling, general and administrative (SG&A) expenses declined

¥5.5 billion to ¥194.8 billion. This was mainly attributable to a ¥3.5

billion reduction in sales expenses at the Group’s graphics image

sales company due to an adjustment for exchange rate movements.

Experimental research expenses rose ¥1.4 billion and expenses

owing to the depreciation of the yen increased ¥4.1 billion. As a

result, the net cutback in other expenses was held to ¥2.0 billion.

(Billions of Yen)

0

150

300

450

600

’99 ’00 ’01 ’02 ’03

Net Sales

(Billions of Yen)

0

10

20

30

40

50

’99 ’00 ’01 ’02 ’03

Operating Income

Konica Corporation and Consolidated Subsidiaries